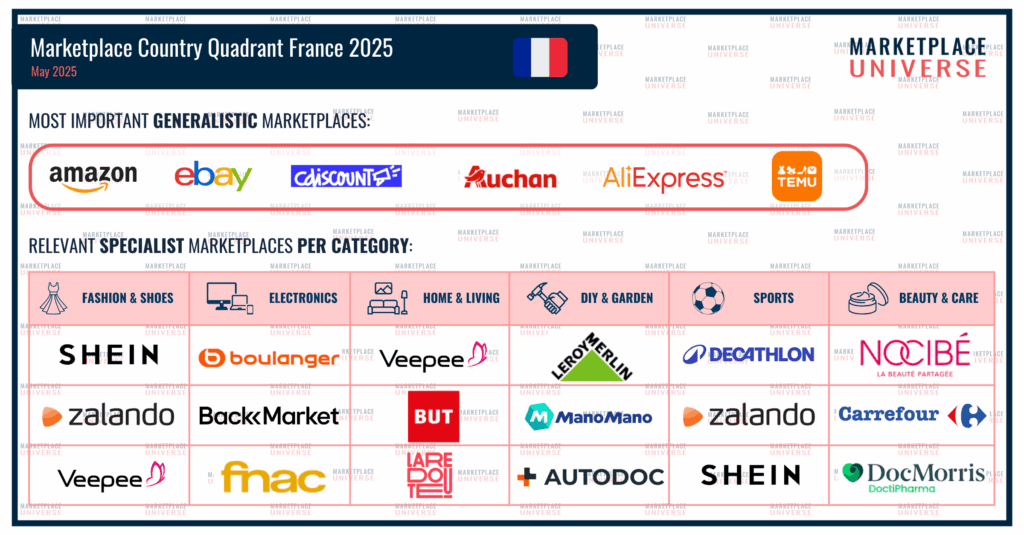

These are the 25 most important marketplaces for selling to France!

France continues to be one of the most dynamic and diverse marketplace ecosystems in Europe. With a 2024 e-commerce turnover of €69.6 billion (up 5.9% YoY), a population of 64 million, and an online share of 16.8%, the country is an increasingly attractive destination for brands and retailers exploring growth beyond their home market.

And yet — this complexity makes France a difficult market to assess at a glance. Behind well-known players like Amazon and Shein, the French landscape is full of powerful local heroes, strong category specialists, and platforms that have quietly built massive market relevance.

That’s why we’ve updated our Marketplace Country Quadrant France, edition 3 (2025) — and once again, it was more a matter of who to leave out than who to include.

The French market

In 2024, e-commerce turnover in France reached €69.6 billion, representing a 5.9% increase over the previous year — a notable acceleration compared to 2023. The online share of total retail climbed to 16.8%, showing that French consumers are continuing to shift steadily toward digital.

Marketplace penetration is estimated at around 40% of online sales, though exact numbers remain elusive. France’s top online stores by turnover in 2024 were Amazon, Shein, Veepee, Apple, and E.Leclerc — underlining the strong mix of global tech, fast fashion, promotional retail, and grocery in France’s e-commerce scene.

Amazon continues to lead in reach and relevance, but the market is far from Amazon-only. French consumers are brand- and price-sensitive, and tend to distribute their online spend across many different platforms depending on category, product, and season.

The generalists in the Marketplace Country Quadrant France

The generalist segment is still led by international giants. Amazon, eBay, AliExpress, and Temu dominate across a wide range of product categories. But France also has one of the most active domestic generalists: Cdiscount. These five remain the core pillars of marketplace-based e-commerce in France.

One player that drops out of the generalist section in 2025 is Carrefour. While it remains a powerful omnichannel retailer and relevant in food and personal care, its marketplace relevance is highly category-specific and no longer broad enough to justify inclusion among the generalists.

The specialists in the 6 categories

Fashion

France remains a fashion powerhouse — and the marketplace landscape reflects that. For the first time, Shein enters the quadrant. The fast-fashion giant is now the second-largest online fashion retailer in France, behind Vinted. However, Vinted is not listed in the quadrant due to its C2C model — our focus remains on marketplaces accessible to B2C sellers and brands.

Also new in the quadrant: Veepee, the French shopping club, which continues to drive strong traffic and sales, particularly in branded outlet fashion. Zalando remains a relevant cross-border player, while Farfetch and La Redoute are no longer listed — either due to reduced market relevance or space limitations.

Electronics

Electronics is one of the most transformed categories in this update. The biggest change: the addition of Boulanger, a large French electronics retailer with a strong and growing marketplace operation that had flown under the radar until now. Backmarket, focused on refurbished tech, also joins the quadrant — now ranked as the second-largest online shop in France. Local hero FNAC also specialises in electronics and is a strong markeplace.

Out go Rue du Commerce and Pixmania, both still active but no longer influential enough in terms of scale and reach to secure a place in the updated quadrant.

Home & Living

This category reflects the evolving nature of marketplace engagement in France. Veepee appears again here, as the platform’s wide product range and daily deal formats cover much of the home space. New in the quadrant is BUT, a strong omnichannel retailer and marketplace that’s gaining ground fast. La Redoute, which has lost relevance in Fashion, nevertheless maintains its strong position in Home & Living.

Maisons du Monde and Conforama are no longer featured in the visual — not due to irrelevance, but due to the sheer density of strong candidates. Both are still notable players for home brands targeting France.

DIY & Garden

There’s a newcomer here that might surprise some: Autodoc. While headquartered in Germany, Autodoc only runs a B2C marketplace model in France, focusing on car parts and accessories — and its growth puts it firmly in our top 3. The local omnichannel powerhouse Leroy Merlin and marketplace dinosaur ManoMano round out the category.

Darty has been removed this year, as its focus remains primarily on white goods and electronics rather than DIY and garden verticals.

Sports

The sports category has lost one of its former players: Colizey, which has ceased operations. Replacing it is Shein, which now plays an increasing role in sports fashion in France — especially among younger audiences. Decathlon remains the unchallenged leader in this space, with Zalando continuing to be relevant for branded activewear.

Beauty & Care

In Beauty & Care, the most important change is the replacement of Zalando with Carrefour. While Zalando has significantly reduced its marketplace engagement in beauty across Europe, Carrefour’s strong reach in FMCG and personal care make it a major platform in this space.

Also remaining in the quadrant are DocMorris and Nocibé, the French cosmetics chain known in Germany under the Douglas brand.

🧭 What this tells us about the French market

France’s marketplace environment remains broad, category-driven, and surprisingly local. In nearly every segment, there are strong domestic players competing head-to-head with international giants. This is not a one-platform market. And even among the largest global players — like Amazon or Shein — success in France demands local adaptation, brand sensitivity, and often, a different set of logistics and marketing assumptions.

From a seller’s perspective, it’s a market with a lot of potential — but one where you need to know where to look, and how to prioritize.

Explore more

The France Country Quadrant is part of a broader series of visual overviews that help marketplace professionals understand the most relevant platforms — by region and by category.

👉 Check out our full collection of country and category quadrants here.