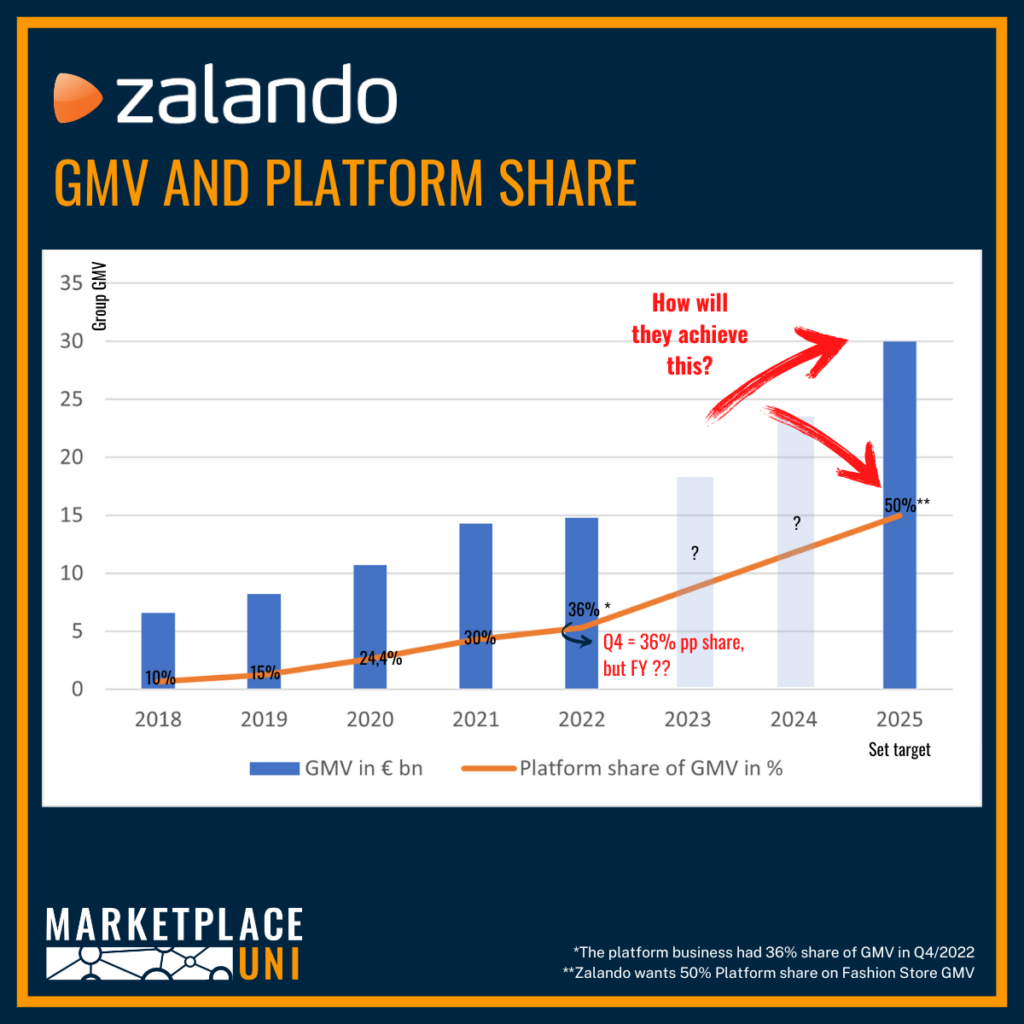

Zalando’s marketplace strategy: The annual figures for 2023 reveal a lot about the strategy for the Berlin-based company’s marketplace business. We therefore take a critical look at the figures, the most striking changes and the targets that Zalando has now set for the future.

Recalibrated partner target

Last year, Zalando recalibrated their Partner Goal: originally set at 50% for 2025, it’s now adjusted to 40-50% by 2028. But what’s really going on beneath these numbers?

For Q4 2023, Zalando reported a 39% Fashion Store GMV Share, a slight climb from 36% the previous year. Although there’s evident growth, we’re also seeing a strategic pivot. Zalando has expanded its goalposts, both in time and in scope, moving from a Fashion Store GMV to a broader B2C GMV base – which stood at 32% in 2023. This shift in their reporting parameters may cloud direct comparisons, yet it’s a pivotal change reflecting their strategic evolution, as illustrated in the second picture of this article.

Now, let’s dissect the details and look at Zalando’s strategic B2CpPillars:

1. Differentiation through Quality

Zalando is opting for quality over quantity, cherry-picking high equity brands like @Lacoste, and adopting local approaches for different markets – such as France. This move has seen them pare down their assortment.

Notably, last year saw the exclusion of many brands, and now, brand approvals have become stringent, sometimes even varying by country. This strategy aims for a ‘cleaner’ brand environment.

2. AI-Driven Sizing and Reduced Returns

60% of all items sold get a AI based size advice which lead to 14% less returns on size-related returns which is quite good, because Zalando Germany has the highest return rates of all (marketplaces) in Europe

3. Shifting to B2B: Strong Brand Partnerships and Ecosystem Expansion

Zalando’s focus on strengthening brand partnerships is evident with over 6,000 brands on board. They are also becoming more selective in their wholesale buying, with 62% of items shipped through ZFS – up from 58% in 2022. The transition to a platform model has progressed, as reflected by a 12% growth in their Partner Business GMV.

4. Lifestyle Extension and Entertainment

In addition, there is a lifestyle expansion into sports and credible assortments as well as a stronger focus on inspiration & entertainment as shopping drivers.

Conclusion of Zalando’s new Marketplace Strategy

Overall Zalando grew in the Partner Business by 12% and also with ZFS. The shift from quantity to quality leads to a cleaner customer experience with more curated assortment. Zalando made their switch to focus on profitability last year. ZEOS will become super interesting in the coming years and is a core pillar for Zalando’s marketplace strategy.