Selling through online marketplaces offers enormous opportunities for brands and retailers – especially in cross-border commerce. But anyone wanting to sell internationally must deal intensively with one topic: VAT. And it’s a tricky one. Despite EU-wide rules, the reality remains complex. Different VAT rates, national exemptions, and ever-changing regulations make VAT one of the biggest stumbling blocks in European e-commerce. That’s why we’ve put together this guide: VAT-Traps: 7 Critical Rules Every Marketplace Seller in Europe Needs to Know. It highlights the key differences, common pitfalls, and action points – especially for marketplace sellers and brands with international ambitions.

A patchwork despite EU directive

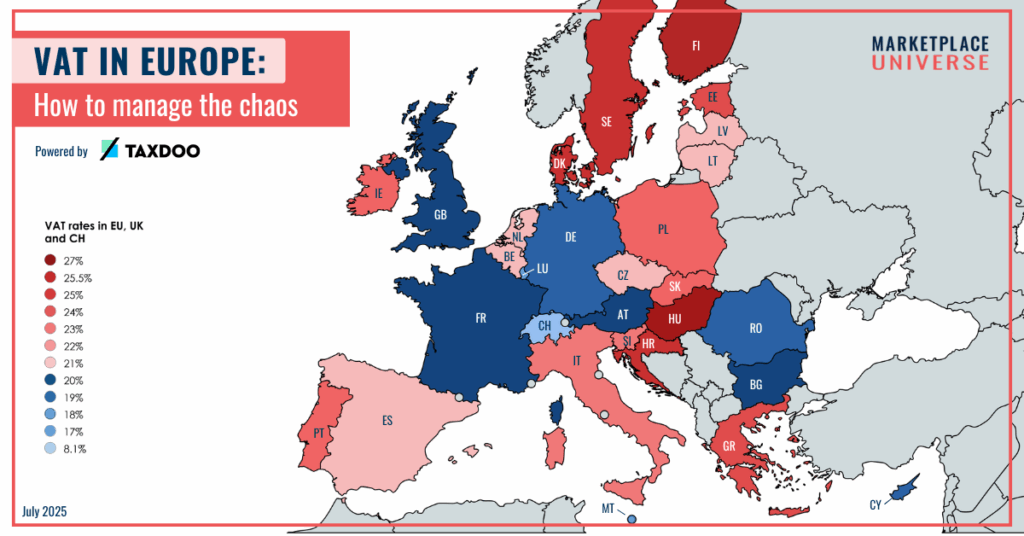

The EU VAT Directive defines the legal framework for VAT rates – but implementation is left to the Member States. The result: each country has its own rates, reporting obligations, and deadlines. Businesses need to know not only where they are liable to pay VAT but also which rate applies.

One example: children’s clothing is taxed at 0% in the United Kingdom, while in most EU countries, the standard VAT rate applies. Denmark does not apply reduced rates at all – taxable supplies there are generally subject to either the standard 25% rate or the zero rate.

What VAT rates exist in the EU?

There are several types of VAT rates across the EU:

• Standard rates (minimum 15%): Apply to most products.

• Reduced rates (minimum 5%): For example, for food or books.

• Super-reduced rates: Below 5%, only allowed in a few countries.

• Zero rate (0%): For essential or educational goods.

• Parking rates: Special arrangements for accession countries, e.g. reduced VAT on goods not normally eligible.

What changed in 2025

With a reform that took effect on 1 January 2025, the EU introduced greater flexibility: since then, Member States have been allowed to apply two reduced VAT rates below 5%. Additionally, the EU approved 24 categories of goods and services for lower VAT rates. In return, VAT benefits for environmentally harmful products are set to be phased out by 2030.

Where is VAT to be paid?

One of the key challenges in cross-border e-commerce is determining the correct place of taxation. This determines which VAT rate applies and in which country the tax must be paid.

Since 1 July 2021, a uniform principle applies to B2C distance sales within the EU: VAT is to be paid in the destination country, that is, where the consumer resides. This means: a German business selling to a customer in France must apply the French VAT rate and remit the tax there – not the German rate. An overview of all tax rates in Europe can be found here.

Exceptions and special rules:

• Small business threshold: For EU-based companies, a sales threshold of €10,000 per year applies to the sum of all cross-border B2C sales. If this threshold is not exceeded, the VAT rate of the country of origin may still be used.

• Difference depending on type of supply:

– Goods with physical shipping generally fall under the destination principle.

– Digital or other services often follow separate rules – e.g. the place of supply rule based on service type.

• B2B vs. B2C: For sales to business customers (B2B), different rules apply. In many cases, the reverse charge mechanism is used, meaning the customer is liable to pay the VAT – not the seller.

OSS procedure: One-stop instead of tax chaos?

With the One Stop Shop (OSS), the EU created a major simplification for cross-border sales. The principle: instead of registering for VAT in each individual EU country, sellers can report and remit all relevant sales centrally via the OSS portal in their home country.

The OSS is a voluntary but binding simplification for online sellers and includes three procedures:

- Union OSS for:

• EU businesses making cross-border B2C sales of goods

• Digital services to EU consumers

• Marketplace sales where the marketplace acts as the deemed supplier

Example: A German seller operates a web shop and sells to customers in France, Spain, and Italy – and reports all sales through the German OSS portal.

- Non-Union OSS for:

• Non-EU businesses providing digital services to EU consumers

Also an example: A US software provider sells downloads to customers in Europe.

- Import OSS (IOSS) for:

• Imported goods with an intrinsic value of up to €150

• B2C sales – whether from within or outside the EU

Example: A Chinese seller offers products via a platform like AliExpress or Temu and ships them directly to customers in Germany.

Important: Once OSS – always OSS

Participation in the OSS scheme is voluntary. However, once chosen, all relevant transactions must be reported via OSS. Selective application – yes today, no tomorrow – is not allowed.

Benefits of OSS:

• Centralised registration and reporting: No need for multiple VAT registrations across the EU

• Reduced administrative burden: Monthly or quarterly reporting depending on the scheme

• Legal clarity and transparency for authorities and sellers

However, the OSS procedure also has its limits. It only applies to B2C transactions. Local taxes such as environmental or packaging levies remain in place. OSS also does not cover B2B transactions, stock held in foreign warehouses, or services outside the scope of OSS.

Practical tip: Anyone planning to expand internationally or ship to multiple EU countries should assess early on whether OSS is a suitable solution – and consider seeking tax advice.

When is the marketplace responsible for VAT?

Since 1 July 2021, new VAT rules apply in the EU for online sales. One of the key changes concerns the role of online marketplaces such as Amazon, eBay, Kaufland, Etsy, or Zalando. In certain cases, these platforms are deemed to be the supplier – and are therefore responsible for collecting, remitting, and reporting VAT themselves.

When does this rule apply?

A marketplace becomes VAT-liable when three conditions are met:

- The sale is made to a private individual (B2C) within the EU

- The sale is made via a marketplace or platform, meaning the platform provides technical functionality for ordering and payment

- One of the following situations applies:

- A non-EU business sells via a marketplace to EU consumers. Example: A Chinese seller offers goods on Amazon.de to German consumers. Amazon is then liable for the VAT.

- Imported goods (from third countries) with a value of up to €150. Example: A Polish marketplace seller ships goods from a warehouse in Turkey to France.

- The marketplace must account for VAT under the IOSS scheme. Intra-EU supplies by third-party sellers where the marketplace facilitates the sale. Example: A Spanish seller offers products to German customers via a platform. The marketplace is liable if it acts as the deemed supplier – for example, via platform-based fulfilment.

In all other cases, the seller remains responsible. If the above conditions are not met, the seller remains responsible for the VAT – for example, when an EU-based seller ships goods from a domestic warehouse to consumers in the same country.

What does this mean in practice? Sellers must understand when the platform is responsible for VAT – and when they are themselves. Even when the platform collects the VAT, the seller is still responsible for correct pricing including VAT. Platforms such as Amazon or eBay indicate who is responsible for VAT collection in each transaction. Marketplaces often include this information in order confirmations or invoices. To stay compliant and competitive, sellers should regularly review their VAT setup – and revisit resources like this overview of VAT-Traps: 7 Critical Rules Every Marketplace Seller in Europe Needs to Know.

Practical tip for sellers: Sellers should regularly review the VAT rules of the marketplaces they use. Especially in cross-border sales or fulfilment scenarios like Amazon FBA, your VAT role can change – sometimes without you realising it.

What incorrect VAT rates can cost you

Incorrect VAT rates are more than just a formal error – they directly affect margins, prices, and legal certainty.

Two typical mistakes:

- VAT rate too low:

If a seller applies the German VAT rate of 19% to deliveries to Sweden, where 25% applies, they must pay the difference out of pocket.

Example: With 1,000 sales at €100 gross each, over €4,000 in VAT would be missing. - VAT rate too high:

Sellers who apply the standard rate instead of the reduced one risk inflated gross prices and shrinking margins.

Example: Children’s books in France are subject to 5.5%, not 20%.

The consequences include a growing risk of tax audits, margin losses or refund claims, and weaker competitiveness due to inflated VAT-inclusive prices. This shows that correct VAT application is not a “nice to have”. It is a must for successful growth in European e-commerce.

Conclusion

For brands and sellers on marketplaces, the following applies:

• Regularly check which VAT rates apply to your products in each target market.

• Use the OSS procedure if it fits your business model.

• Pay attention to your platform role: Who is liable for VAT – the marketplace or the seller?

• Seek professional tax advice when scaling cross-border.

Where can you get help?

If this all feels overwhelming and you need help, you can turn to Taxdoo. The Hamburg-based TaxTech company supports brands and retailers in navigating complex and nerve-wracking tax issues. To this end, it specializes in automation solutions for VAT compliance and accounting in e-commerce, especially for marketplace businesses. You can find the support you need here: https://visit.taxdoo.com/NQ3UG6

For more information, check out our (German-language) webinar with Taxdoo, “Successful expansion into Europe: Tax and accounting for marketplace sellers made easy,” which you can watch here or listen again to our (also German-language) podcast episode 75 with Taxdoo.

So that brands and sellers know where and how much VAT is due, here is a complete overview of all VAT rates in the EU plus the UK and Switzerland. Fill in the form below to get your download. (If you don´t see a form click here.)

You are currently viewing a placeholder content from Active Campaign Form 13. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information