The Netherlands is one of the most digitally advanced e-commerce markets in Europe. By 2029, the share of online retail in total commerce is expected to rise from 18% to 25%. At the center of this market is bol: With an estimated GMV of around 5.6 billion USD and over 1.6 billion USD in revenue in 2025 alone, the platform represents the dominant marketplace model in the region, as reported by the ECDB e-commerce database. This makes bol highly attractive to many European brands and sellers. But which product segments are performing well? Where do assortment gaps exist? And what should new sellers focus on? The following insights into Categories and Assortments: What’s Working on bol provide guidance.

Seasonal Demand Meets Long-Term Bestsellers

One key strength of bol.com as a generalist platform is its broad product range – covering nearly every area of daily life. However, clear seasonal and structural trends can be observed. Currently, bol.com reports strong demand in classic summer categories such as:

- Camping & Outdoor

- Garden & DIY

- Tools & Safety

- Festivity Supplies

- Furniture

- Bicycles & Accessories

- Footwear

In parallel, there are stable year-round demand segments that remain highly relevant for brands and sellers:

- Baby products & gear

- Children’s clothing, bodywear & underwear

- Craft supplies & construction kits

- Personal care, health & hygiene

- Household goods & kitchen appliances

- Home & living

- Books (among the highest-demand categories)

These stable segments offer long-term revenue potential, especially for brands with established product lines and strong content.

High-Potential Growth Segments – The Latest Market Data

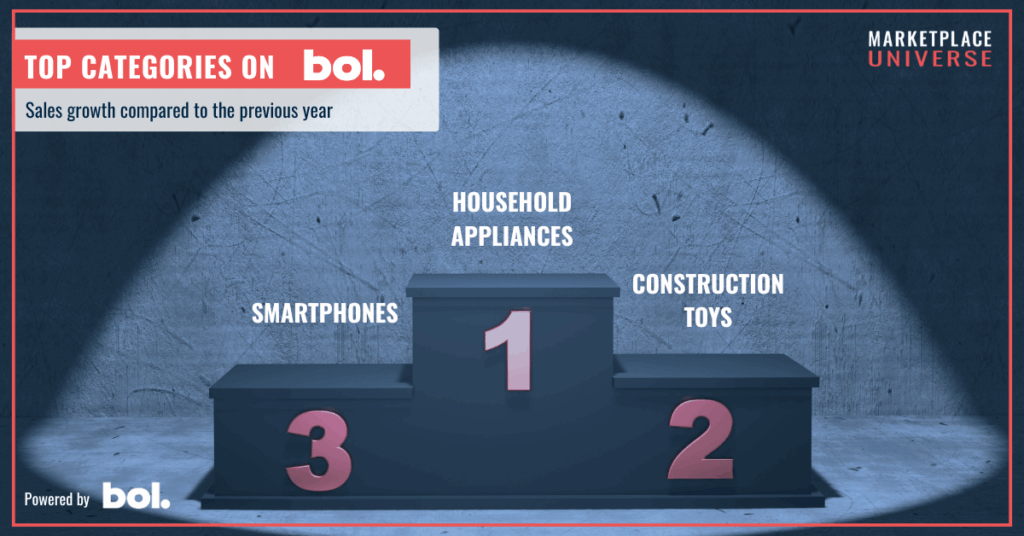

Even more interesting are the categories that are currently experiencing above-average sales growth at bol.com. According to the latest analysis by bol, these categories occupy the top 10 spots. They are all growing at double-digit rates, with household appliances in the upper half, the following categories in the middle, and the bottom spots in the lower double digits.

- Household appliances

- Construction toys

- Smartphones

- Personal audio devices

- Fragrances / perfumes

- Pet food

- Laptops

- Kitchen machines

- Coffee machines

- Pet supplies

Some of these trends mirror broader macroeconomic developments: For example, geopolitical tensions are driving increased demand for batteries, radios, and survival kits. This clearly illustrates how external factors influence consumer behavior – and how flexibly sellers should respond.

Identifying and Filling Assortment Gaps

Which products are missing? Where is demand growing without matching supply? These questions are central for many sellers – and bol.com offers a structured approach to address them.

Through regularly updated whitelists, registered sellers receive product recommendations every two months for items that are highly searched but underrepresented. Sellers who fill these gaps currently benefit from a promotional incentive: a 50% discount on sales commission for listed whitelist products until August 14, 2025.

In addition, the bol.com Partner Dashboard provides sellers with extensive data on demand, conversion, returns, and cart activity – essential for making informed assortment decisions. More information and the latest whitelists on bol Partner Platform or get in contact with bol here.

What Successful Sellers Do Differently

Sales performance on bol.com depends less on the product category itself and more on execution quality. Top-performing sellers demonstrate best practices in several areas:

- Delivery speed: Products available within 24 hours perform significantly better.

- Pricing: Competitive prices remain a key factor for visibility and ranking.

- Product content: Incomplete, imprecise, or poorly translated listings are a major cause of poor sales performance.

Also worth noting: Trend-driven assortments can generate high short-term revenue – such as magnetic toys or seasonal décor items. Sellers with agile operations can clearly benefit in these niches.

Recommendations for New Sellers

For brands and sellers just starting out on bol.com, one rule applies: Sell what you truly understand. Familiarity with the product category allows for better content, more targeted marketing, and faster reactions to market dynamics.

According to the platform, categories with particularly strong success potential include:

- Home & living

- Sporting goods & accessories

- Fashion & bodywear

- DIY, garden, outdoor, mobility (DGOM)

Pro tip: Sellers who already operate successfully on other marketplaces should factor in language and cultural localization when expanding to the Netherlands – including product titles, bullet points, and legal texts in Dutch.

Differences Between the Dutch and Belgian Markets

bol.com serves both the Netherlands and Belgium – but consumer behavior differs between the two countries. In Belgium, categories such as home & living, garden supplies, and electronics & premium devices perform even better than in the Netherlands. International sellers focused on these segments should consider targeting both markets strategically.

Conclusion: Strong Demand, Transparent Data, Clear Recommendations

bol.com offers an attractive market environment for European brands and sellers – combining high visibility, data-driven category management, and active partner support. The marketplace actively drives assortment expansion through external sellers, supported by whitelists, dashboards, and structured onboarding.

For those seeking to establish a strong presence in the Dutch market, bol.com currently offers ideal entry conditions – provided that pricing, assortment, and logistics are aligned. Especially in high-growth categories such as household appliances, consumer electronics, toys, and pet care, concrete sales opportunities are opening up right now.