Discover how Amazon’s dominance in Europe is being challenged by Chinese platforms like AliExpress, Shein, and Temu. Explore platform penetration, growth, and regional trends in 2025.

The European e-commerce market is shifting faster than ever. While Amazon continues to hold a strong position in many countries, Chinese platforms such as AliExpress, Shein, and Temu are rapidly expanding their reach, particularly in Southern Europe and Central and Eastern Europe (CEE). The latest data from EU Transparency Reports reveals a striking trend: in several countries, Amazon’s dominance is being challenged as these Chinese platforms capture market share with aggressive growth strategies, competitive pricing, and localized offerings.

In this article, we dive deep into the numbers to uncover which platforms dominate which countries, where penetration is skyrocketing, and which markets are witnessing the fastest growth among Chinese platforms. We explore regional trends—from the Nordics to Southern Europe—and reveal a surprising insight: in countries where Amazon’s presence is weaker, AliExpress, Shein, and Temu are not just filling the gap—they’re expanding at record pace. By the end of this analysis, you’ll understand where Amazon remains unchallenged, which markets are turning into battlegrounds for Chinese marketplaces, and why AliExpress, often underestimated, is quietly becoming a European powerhouse.

Understanding “Penetration”: How Many Users Are Actually Using These Platforms?

When we talk about penetration, we mean the share of a country’s population that actively uses a given platform in a given period. For instance, if Amazon has a penetration of 65% in Germany, roughly 65% of German internet users visited or used Amazon in that period.

These numbers are sourced from EU Transparency Reports, published under the Digital Services Act (DSA). Under the DSA, Very Large Online Platforms (VLOPs)—platforms with more than 45 million monthly active users in the EU—must track their average monthly users per EU country using standardized methods and report them publicly at least twice per year. This ensures transparent, comparable data for platforms like Amazon, AliExpress, Shein, and Temu, allowing analysts and businesses to track market reach and growth across Europe.

Amazon: Still Strong, but Losing Ground in Some Markets

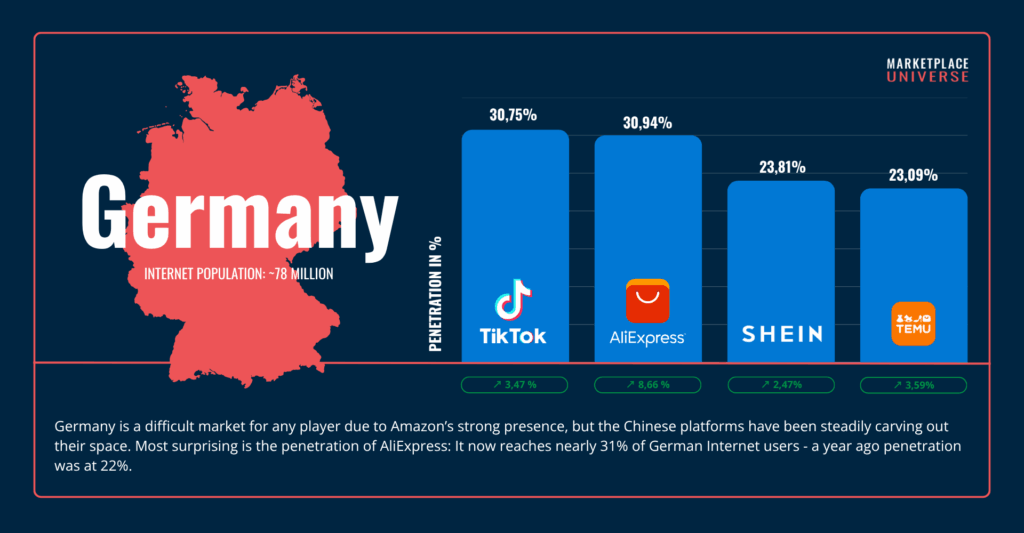

As of HY1/2025, Amazon remains dominant in Western Europe, with penetration rates of:

- Germany: 65.4%

- France: 53.8%

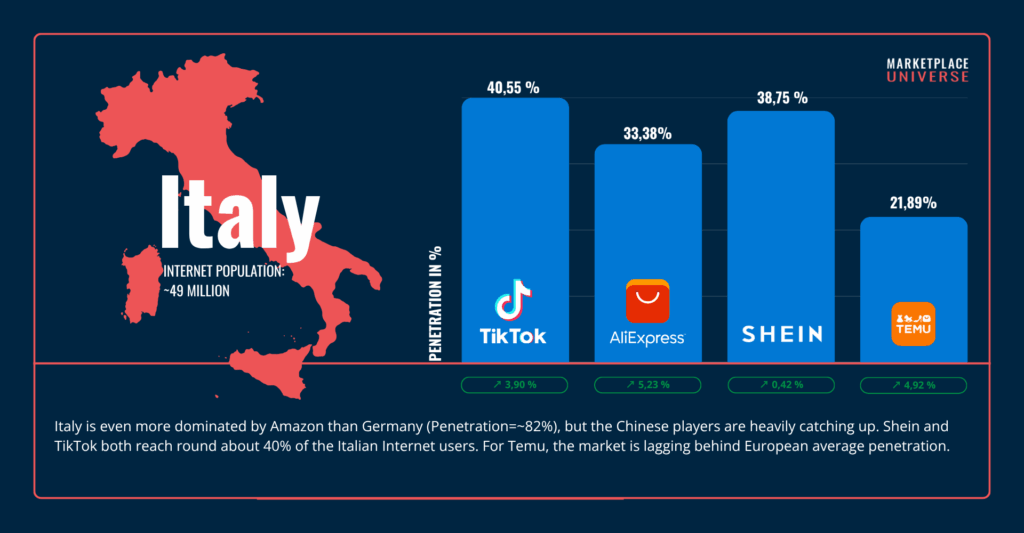

- Italy: 68.9%

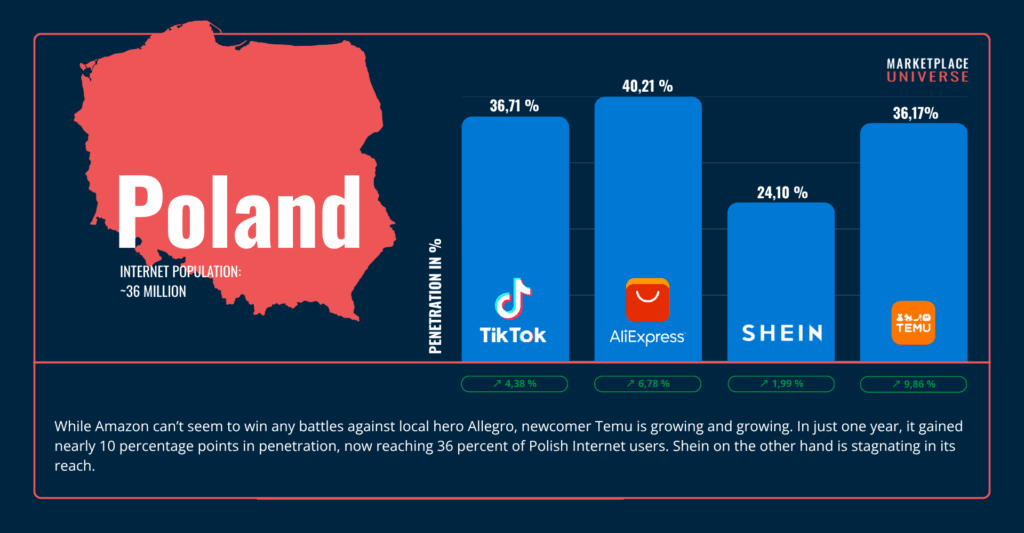

However, Amazon’s position is less dominant in Poland (9.8%) and the Nordics, where penetration is significantly lower. In Sweden, Denmark, and Finland, Amazon’s share of the market is relatively modest, signaling opportunities for other players.

The Rise of Chinese Marketplaces

AliExpress: The Quiet Powerhouse

Often underestimated, AliExpress has a formidable presence in Europe:

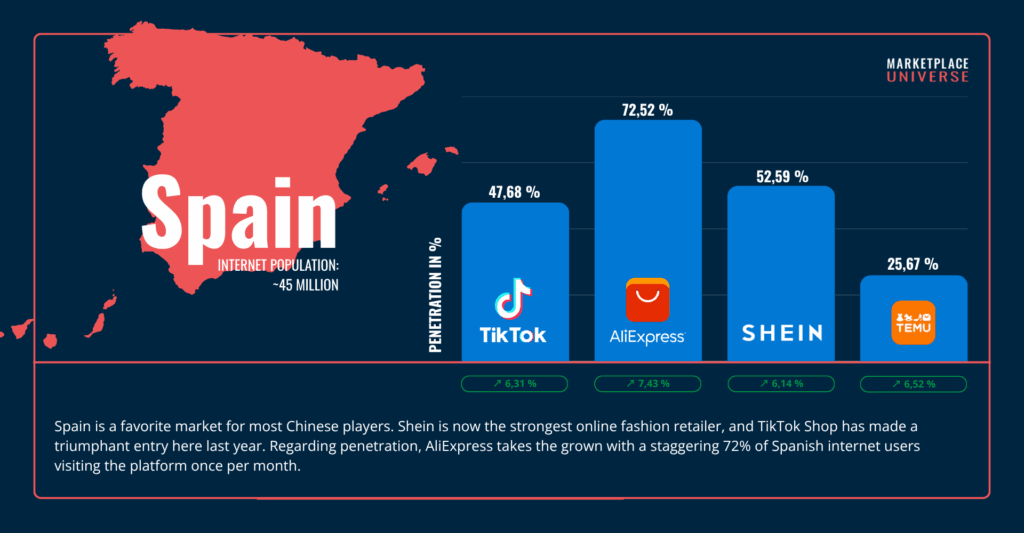

- Spain: 72.5% penetration

- Italy: 33.4%

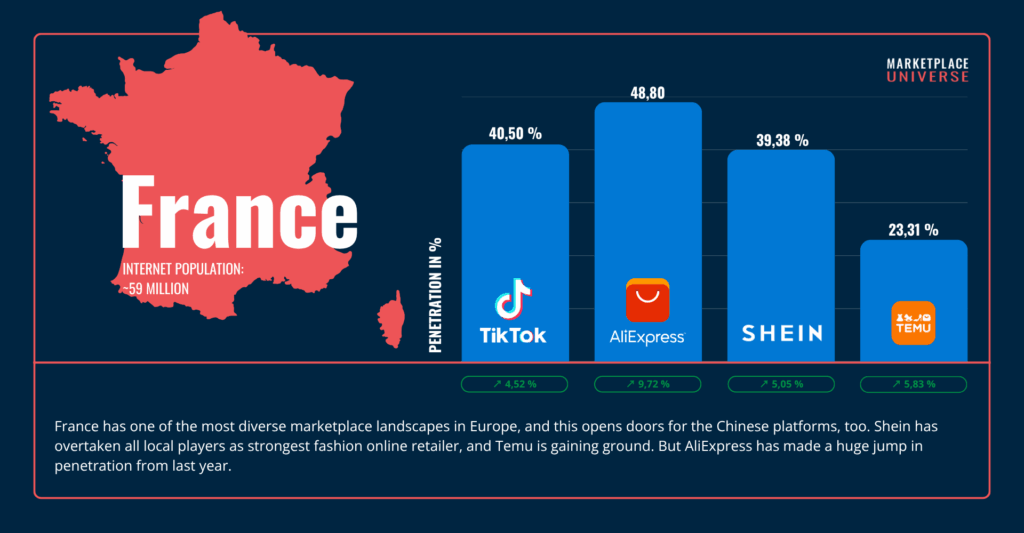

- France: 48.8%

Its strong growth in Italy (+8.0%) and France (+4.6%) indicates that AliExpress is expanding quickly, competing not just with Amazon but also with Shein.

Shein: Surging in Southern Europe

- Spain: 52.6% penetration, growth of +13.2 percentage points

- France: 39.8%, growth of +14.5 percentage points

- Poland: 24.1%, growth of +9.0 percentage points

Shein continues to expand rapidly in Southern Europe, especially in markets where Amazon’s growth has plateaued.

Temu: Breaking Out in CEE

- Poland: 36.2% penetration, growth of +37.5 percentage points

- Spain: 25.7%, growth of +34.0 percentage points

- Italy: 21.9%, growth of +29.0 percentage points

Temu is a relative newcomer but is growing faster than any other platform in Poland, signaling the strategic importance of CEE markets for Chinese platforms.

Regional Trends: Where the Competition Heats Up

Southern Europe: A Battleground for AliExpress and Shein

In Spain and Italy, Chinese platforms are capturing market share aggressively:

- AliExpress: 72.5% in Spain, 33.4% in Italy

- Shein: 52.6% in Spain, 39.8% in France

Amazon remains present but is no longer unchallenged. Southern Europe has quickly become a key battleground for these platforms.

CEE: Poland as a Growth Hotspot

Poland is witnessing a Chinese platform boom, led by Temu, with strong contributions from AliExpress and Shein. The country’s lower Amazon penetration creates a clear opening for newcomers.

Nordics: Amazon Holds, but Chinese Players Are Creeping In

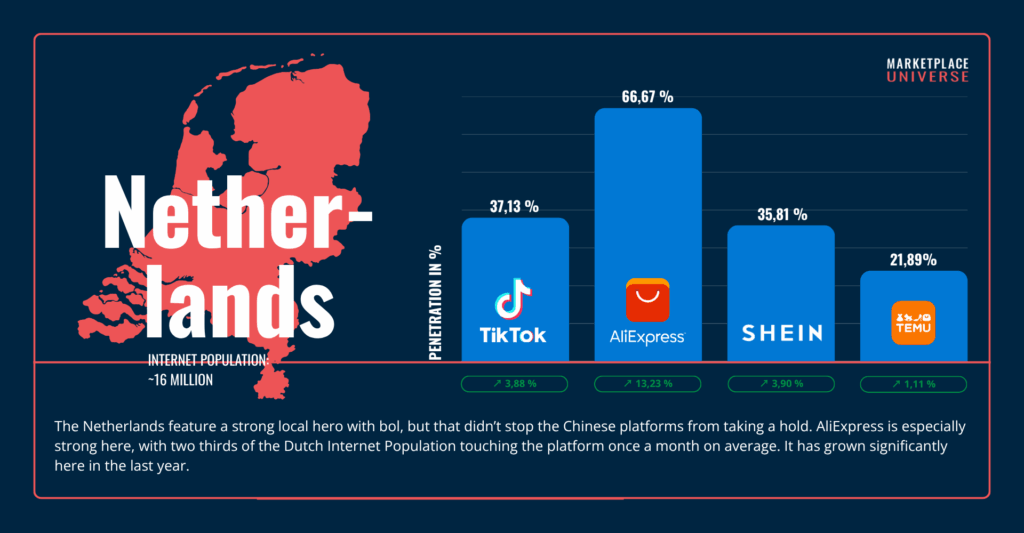

In the Nordic countries, Amazon maintains a strong presence, but growth from Shein and AliExpress is visible:

- Shein: +1.0 percentage points in Finland

- AliExpress: steady growth, slowly increasing its footprint

While still dominated by Amazon, the Nordics show early signs of market diversification.

Weak Amazon, Strong Chinese Players: A Clear Pattern

The data reveals a direct correlation: where Amazon is weaker, Chinese platforms grow faster.

Poland: Amazon penetration 9.8%, AliExpress 40.2%, Temu 36.2%

Southern Europe: In Spain and Italy, AliExpress and Shein are dominant as Amazon’s growth slows

This trend shows that Chinese marketplaces are exploiting gaps in Amazon’s regional coverage, using competitive pricing, fast delivery, and localized assortments to gain traction.

Conclusion: Europe’s E-Commerce Landscape Is Changing

Amazon’s dominance in Europe remains strong in Western Europe, but the rise of Chinese platforms—AliExpress, Shein, and Temu—is undeniable. These players are growing rapidly in Southern Europe and CEE, capturing market share and challenging Amazon’s position.

For retailers, understanding these shifts is critical: markets that seem mature may already be turning into battlegrounds for fast-growing competitors. Meanwhile, AliExpress, often overlooked, is quietly becoming a powerful force in Europe, reshaping the competitive landscape.

As these platforms continue to innovate and expand, European e-commerce is entering a new era—more competitive, diverse, and dynamic than ever before.

Want to check out how the presence of the Chinese platforms changed with in our year? Find our last year’s analysis of the Transparency Reports Data here.