Why Internationalization Has Been the Key Growth Factor in 2024

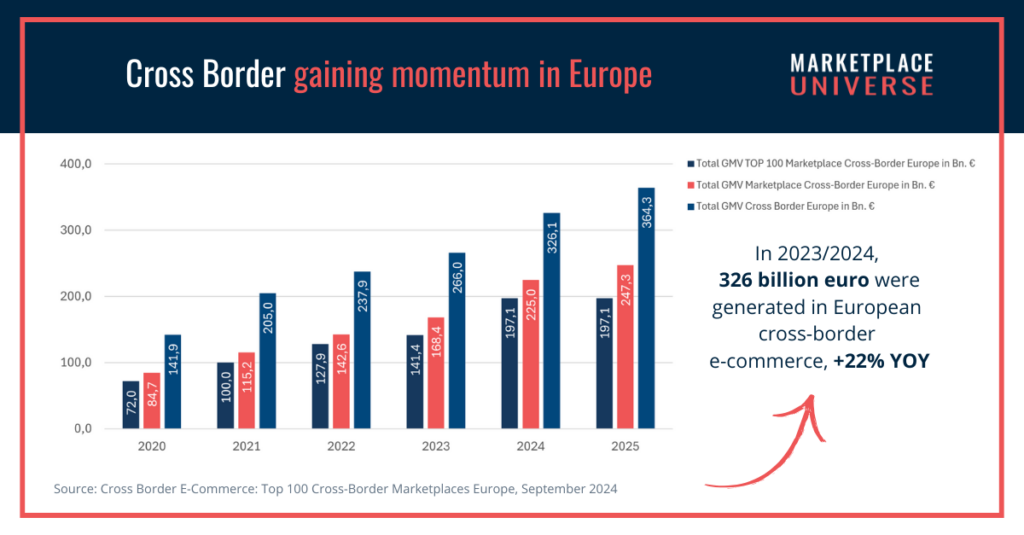

One of Marketplace Universe’s key predictions for marketplace business development in 2023 and 2024 was clear: internationalization would drive growth, even in a challenging economic environment. Now, as we review the first set of available data, we can say confidently: our predictions were spot-on. While e-commerce markets across Western Europe have faced economic headwinds in 2023, European cross-border sales have continued their upward trajectory. This trend is highlighted by recent data from “Cross-Border E-Commerce“:

In 2023/2024, European cross-border e-commerce generated €326 billion, reflecting a 22% year-on-year growth. The numbers show that cross-border commerce remains resilient, unaffected by both the pandemic-fueled boom and the subsequent economic slowdown that has dampened national e-commerce growth rates. Internationalization is here to stay.

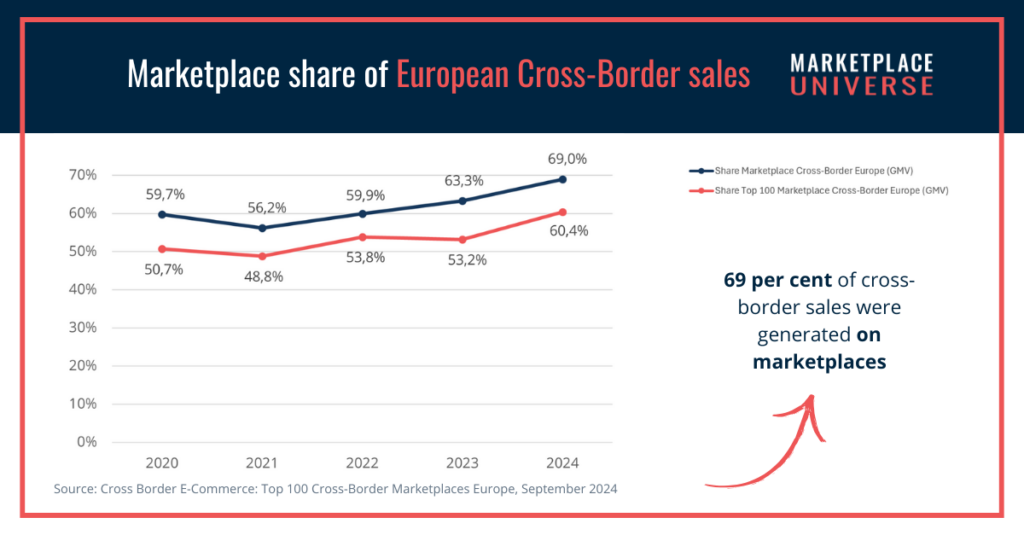

What’s Driving this growth? Marketplaces!

Marketplaces are the primary engine behind cross-border growth. In 2023/2024, a remarkable 69% of all European cross-border sales took place on online marketplaces. According to CB Commerce, the majority of this revenue (over 60%) and the highest growth rates come from the top 10 platforms active in Europe: Amazon, eBay, AliExpress, Etsy, Temu, Vinted, OLX, Shein, Discogs, and Zalando. However, many mid-tier platforms are also capturing significant cross-border revenue, benefiting from this ongoing trend.

In challenging economic times, cross-border business on online marketplaces has proven to be a strong growth area. But which industries are making the most of it?

Cross-border e-commerce is particularly prominent in smaller European economies, where it makes up a larger percentage of online sales. Markets such as the Netherlands, Belgium, Denmark, Austria, Czechia, and Slovakia benefit more robustly from cross-border sales than larger economies like Germany or France, which are slower to capitalize on the trend. The UK, with its close ties to the U.S. market, has a comparatively weaker share of cross-border turnover within Europe, standing as an exception to the trend.

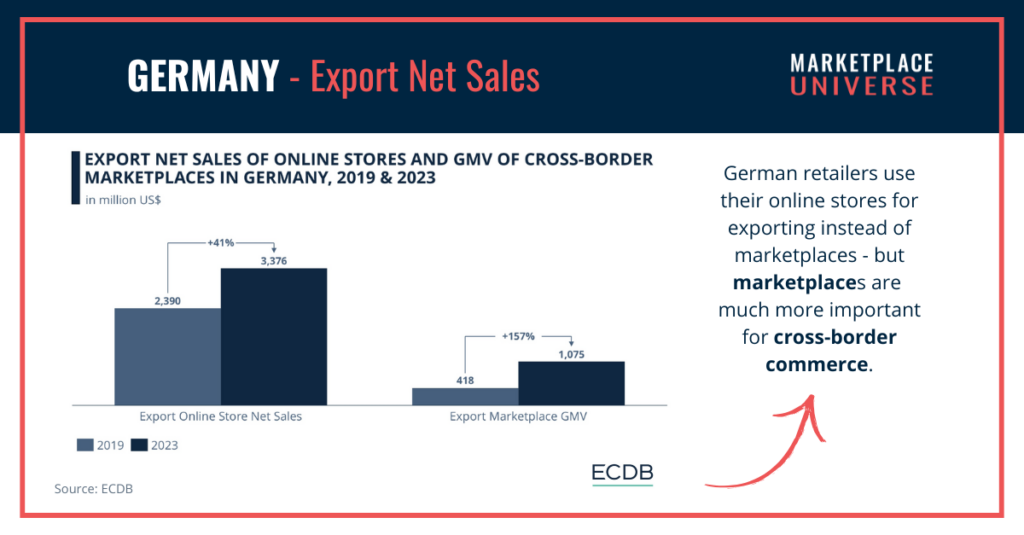

A deeper Look: Cross-Border in Germany

To illustrate this, let’s examine the German market, the largest in the EU. Historically, German e-commerce has been slower to embrace cross-border opportunities, but a shift has begun over the past five years. According to a recent ECDB study:

Export net sales from German online stores grew by 41% between 2019 and 2023. However, these figures remain modest, indicating substantial growth potential. In 2023, cross-border sales represented only about 5% of Germany’s total e-commerce turnover.

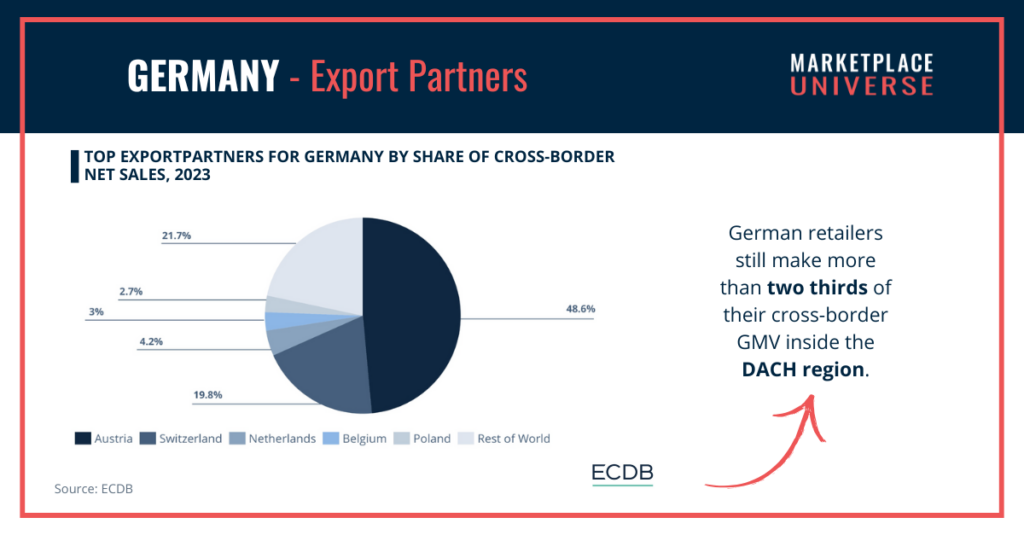

German e-commerce companies also have untapped potential on marketplaces. Their export gross merchandise volume (GMV) comprises just a quarter of Germany’s online cross-border turnover. This limited reach is due in part to a reliance on nearby markets—most German cross-border sales go to Austria and Switzerland. This narrow focus suggests an opportunity for German companies to expand into new, untapped regions and capture more cross-border growth.

Conclusion: The Future of Cross-Border Growth Lies in Marketplaces

As we move forward, it’s clear that internationalisation will continue to be a defining force in the European e-commerce landscape – and that cross border grows on marketplaces. Despite economic uncertainties and slower growth in traditional e-commerce sectors, internationalization offers a vital pathway for expansion, especially on online marketplaces. Companies that prioritize cross-border strategies and leverage marketplace platforms will be best positioned to thrive in this evolving landscape. By expanding beyond familiar markets and tapping into emerging opportunities across borders, businesses of all sizes can unlock new streams of revenue and strengthen their resilience in the face of economic challenges. For those ready to take the leap, the potential rewards are vast—and the time to act is now.

Your starting point for your Cross Border marketplace journey: Our Marketplace Country Quadrants

To help you identify the most interesting marketplaces for your internationalisation endevour, we have started comprising our “Marketplace country quadrants”. This carefully researched and regularly updated infographics inform about the most relevant marketplaces in a certain country market, sorted by industry.

So far, we have published country quadrants for UK, Germany, France, Spain, Italy, the Netherlands, and Switzerland. Check out our country quadrants here.