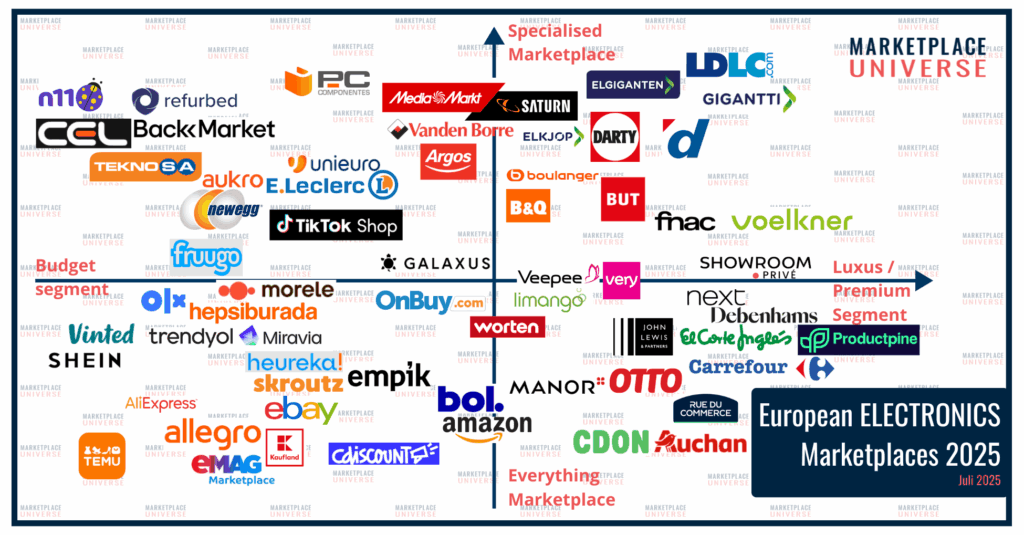

These are the 63 most relevant European B2C online marketplaces for Electronics

Last update: 02 July 2025

The European consumer electronics industry remains one of the most competitive—and dynamic—sectors in e-commerce. Despite already high levels of online penetration, the category continues to grow, fuelled by innovation in product categories, evolving platform strategies, and a booming interest in refurbished products.

According to recent data from Cross-Border Commerce Europe, the European online market for consumer electronics is expected to surpass €90 billion in 2025. E-commerce now accounts for more than half of total electronics sales in many markets. Marketplaces alone are responsible for a significant portion of that turnover—often over 50%—making them a crucial channel for brands and resellers alike.

One of the most significant growth drivers is the refurbished electronics segment, which is attracting new platforms, customers, and competitive dynamics. Sustainability, cost sensitivity, and warranty improvements have made refurbished products increasingly attractive to both consumers and platforms alike. Specialist marketplaces like Back Market and Refurbed are expanding rapidly, while established players like MediaMarkt and Vinted are entering or extending their refurbished offerings.

Meanwhile, retail-based marketplaces are gaining ground, with MediaMarktSaturn launching marketplaces in Poland, Belgium, and soon Turkey, and Fnac Darty teaming up with Unieuro in a powerful Southern European joint venture. This adds meaningful competition to category leader Amazon, which still dominates across most countries.

Temu and Shein are also making waves in this sector—especially in the low-cost segment. While Temu’s aggressive expansion strategy has already brought it into the top tier of budget marketplaces for electronics, Shein is now diversifying its assortment far beyond fashion, with electronics being one of the most visible new categories.

At the same time, UK player OnBuy is stepping up its efforts to expand across Europe. It is positioning itself as a more seller-friendly platform and is currently reaching out aggressively to European brands and merchants.

In short: while the market is consolidating at the top, there’s still a lot of movement across the middle and bottom tiers. The result is a lively and competitive landscape, which we reflect in the updated Marketplace Quadrant Electronics, now featuring 63 active platforms across Europe.

The most important players

The generalists

As in previous years, generalist marketplaces dominate the electronics category, thanks to their wide reach, high traffic volumes, and aggressive pricing strategies.

- Amazon continues to be the market leader in most European countries, often commanding over 20% of the total online electronics turnover.

- eBay remains a strong number two, especially in refurbished and niche product categories.

- Temu has emerged as a dominant player in the low-price electronics segment.

- Shein, originally focused on fashion, has entered the electronics space and is now listed for the first time.

- Regional generalists such as bol (Netherlands), Allegro (Poland), Cdiscount (France), Empik and Morele (Poland), Worten (Portugal), OnBuy (UK), Next, Very, and Debenhams (UK) all include electronics in their top-selling categories.

- Skroutz (Greece), El Corte Inglés (Spain), and OLX (with reach in Romania, Portugal, Turkey, and Bulgaria) further reinforce the relevance of generalists at the national level.

The specialists

While generalists dominate by scale, electronics specialists continue to carve out important market positions, often leveraging brand trust, in-store services, and curated assortments.

- MediaMarktSaturn (Ceconomy Group) continues its internationalisation, with new marketplace operations in Poland, Belgium, and soon Turkey.

- Fnac remains a staple in France and parts of Southern Europe.

- Unieuro (Italy) is now part of a joint venture with Fnac Darty, forming a strong counterweight to Amazon and Ceconomy in Southern Europe.

- Elkjop Group platforms like Elgiganten (Sweden), Elkjop (Norway), and Gigantti (Finland) dominate in the Nordics.

- Digitec continues to lead the Swiss market.

- Vanden Borre is a key electronics player in Belgium.

- Aukro is listed as a specialist for the Czech market.

- N11 adds representation for Turkey’s growing electronics marketplace landscape.

Refurbished on marketplaces

Refurbished electronics is one of the fastest-growing subcategories. Sustainability concerns, attractive pricing, and improved warranty conditions are fuelling customer interest—and platform expansion.

- Back Market remains the leading refurbished marketplace, active in 16+ countries.

- Refurbed, based in Austria, continues its expansion across Central and Western Europe.

- Vinted, better known for fashion, has expanded into refurbished electronics.

- MediaMarkt has added refurbished electronics sections to its marketplace strategy.

- OLX also features strong refurbished offerings, especially in Eastern and Southern Europe.

Conclusion

Conclusion

Even though electronics is one of the most mature e-commerce categories, it continues to show signs of evolution and expansion. While dominant players like Amazon and MediaMarktSaturn hold their ground, new alliances, fresh category entries, and the booming refurbished segment are reshaping the landscape.

Have we missed a marketplace? Do you have any input to add to our quadrant? Let us know!

Check out all our other Marketplace Category and Country Quadrants here!