In a nutshell

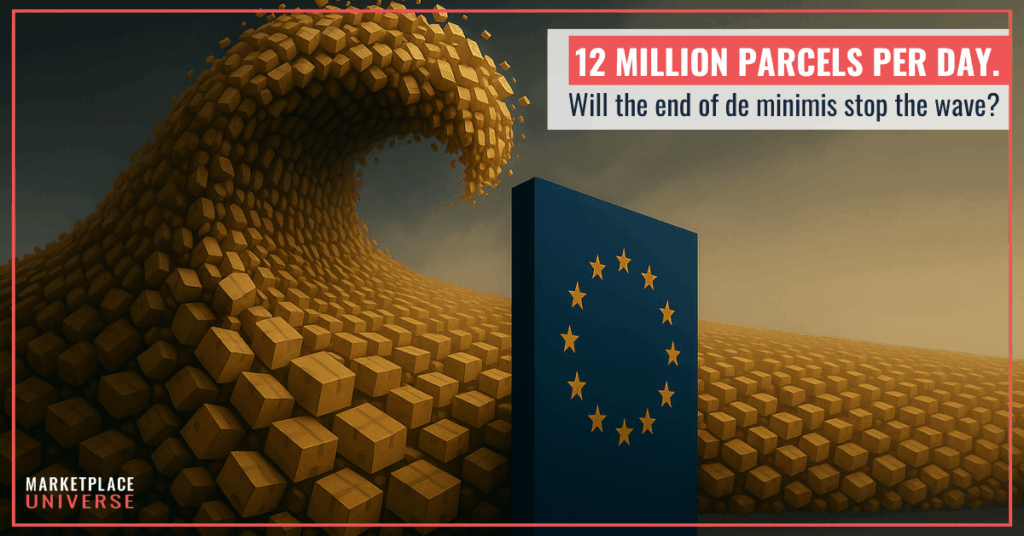

The EU’s decision to end the €150 de minimis exemption in 2026 is set to shake up cross-border e-commerce, particularly for Chinese giants like Temu and Shein. Retailers see it as a win for fair competition, but experts warn it won’t stop the dominance of Chinese platforms. So, will these changes really impact pricing and market dynamics, or are Temu and Shein simply too agile to be stopped?

⏱ Time to Read: appr. 5 min

The End of De Minimis: Will Europe’s New Rules Slow Down the Chinese E-Commerce Giants?

In November 2025, European ministers reached a historic agreement that could change the face of cross-border e-commerce: the €150 de minimis exemption will be abolished by 2026. Until now, small parcels valued below €150 could enter the EU without customs duties, enabling platforms like Shein, Temu, and AliExpress to flood the market with cheap products from China.

The European Commission argues that this loophole has allowed non-EU sellers to flood the market with unfairly priced goods, leaving local European retailers struggling to compete. The new rules aim to level the playing field, closing the door on undervalued imports and improving product safety.

But will it really make a difference?

What Will Change in 2026 and Why?

Come 2026, customs duties will apply to all imports, regardless of value. The idea is simple: no more free rides for small parcels from outside the EU.

Why now? The flood of cheap Chinese goods entering Europe has been growing rapidly. According to EU Economy Commissioner Valdis Dombrovskis, 4.6 billion parcels were imported into the EU in 2024, and a staggering 91% of them came from China. In fact, some estimates suggest that 65% of these parcels were deliberately undervalued to avoid customs duties.

With a market awash in cheap goods, the EU has decided it’s time to act—and fast.

“It’s a defining moment,” said Maroš Šefčovič, European Commissioner for Trade, speaking after the meeting. “This sends a strong signal that Europe is serious about fair competition and defending the interests of its businesses.”

So, what happens now? With tariffs expected to range from 0%-23%, the EU aims to ensure that all businesses, whether based in Brussels or Beijing, must comply with EU regulations.

But will this shift have the desired effect?

Retailers’ Reactions – A Call for Fairer Competition

For many European retailers, this move is long overdue. HDE (Handelsverband Deutschland), the German retail association, has been vocal in calling for a crackdown on unfair competition from Chinese platforms. According to HDE CEO Stefan Genth, this decision marks a necessary shift in leveling the playing field.

“The illegal goods flood from China has to stop,” Genth said. “The €150 exemption has been undermining local businesses. It’s time for strong enforcement.”

EuroCommerce, the EU retailers’ representative body, has echoed this sentiment, calling for harmonized customs procedures across member states. They warned that without a coordinated approach, countries could adopt fragmented rules, which would only complicate enforcement and undermine the level playing field for retailers across the EU.

In France, the government has launched investigations into Shein for selling unsafe products, such as child-like sex dolls, and announced plans to inspect 200,000 Shein parcels at the Paris airport. Retailers in France, represented by bodies such as the Fédération du Commerce et de la Distribution (FCD), have applauded the move, seeing it as a step towards protecting the integrity of the local market.

Giancarlo Giorgetti, Italy’s Minister of Economy, also spoke in favor of the new regulations, saying:

“We welcome the measures that will protect our domestic industries and ensure fair competition.”It’s clear that European retailers believe this regulatory change will give them a fighting chance. EuroCommerce, the EU’s main retail lobby, emphasized that this is an important step towards restoring market fairness.

The Con Side – Why the Regulation Might Not Have the Desired Impact

Here’s where it gets interesting.

Ed Sander, a leading China-commerce expert at Tech Buzz China, doesn’t think this regulation will do much to stop Temu or Shein. In fact, he’s pretty sure they’ll just keep going.

“I’ve seen all the cheers online, but this is not going to slow Temu down,” Sander said. His reasoning is simple: Temu has been adapting its business model for the past 18 months. By shifting operations to local warehouses in Europe, Temu is already setting itself up to avoid many of the new customs duties that will be imposed under the new rules.

Sander argues that even though the EU will impose tariffs on small parcels, platforms like Temu have already been planning ahead. Ed Sander:

“Even when the US introduced high tariffs after the de minimis rule change, Temu quickly recovered. Their operational flexibility is astonishing.”

This is where Björn Ognibeni, a China-commerce expert, echoes the same sentiment. He explains that Temu’s local warehousing means that the new customs duties will not have the same impact on pricing as some may expect.

“Temu can still keep prices low,” Ognibeni said. “Their logistics model is already built to handle these kinds of regulatory challenges.”

For Shein, the situation is more complex. Unlike Temu, Shein operates on a more small-batch production model, which makes local warehousing more difficult. However, Ognibeni suggests that Shein’s profitability and existing infrastructure will allow it to absorb new costs without much issue.Despite the EU’s ambitious plans, both experts agree that Chinese platforms are too agile to be effectively stopped by new import duties alone. The EU’s customs system is not prepared to handle the massive volume of small parcels, and Temu will continue to leverage its local operations to sidestep the impact of the new tariffs.

Key Learnings – What Should Brands and Retailers Take Away?

- Temu and Shein are adapting. While European retailers see the end of the de minimis exemption as a win, experts like Ed Sander and Björn Ognibeni caution that Chinese platforms are too agile to be significantly disrupted by the new rules.

- For European retailers, the lesson is clear: don’t wait for regulation to solve your competition problems. The Chinese platforms have proven time and again that they can bounce back quickly from new regulatory hurdles—whether it’s the US tariffs or the VAT changes in 2021.

- Instead, European businesses need to innovate. Better services, quality products, and stronger customer relationships will be the only way to truly compete in a market that continues to be dominated by agile Chinese e-commerce giants.

- The end of de minimis may help create a fairer marketplace, but it won’t level the playing field on its own. It’s up to European retailers to take the next step.