Retailers and brands from the German market in particular tend to rate the importance of Amazon as a sales channel very highly. This is logical, as an estimated 60 percent of German online sales are made via Amazon.de, as the German Retail Association (HDE) confirmed in its recently published Online Monitor 2024 study. Amazon also has an outstanding position for local e-commerce in other Western and Central European countries. But things look different in other nations. That’s why an internationalization with Amazon is sometimes not enough.

Not Everywhere as dominant as in Germany

Industry observers have long felt that Amazon is having a much harder time in Poland, Sweden or Portugal, for example, than in Germany, Italy or France – but it is only since last year that this feeling can be backed up with concrete figures.

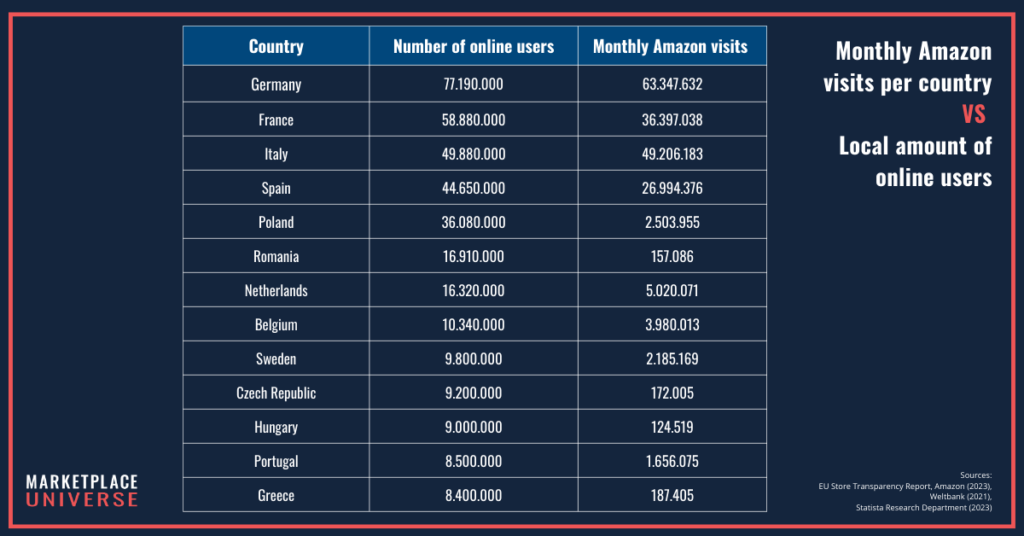

In October 2023, Amazon published its first “EU Store Transparency Report”, in which the platform complied with EU requirements and listed Amazon’s monthly user figures per EU country for the first time. The second edition of this report was published at the end of April and includes Amazon visits in the third and fourth quarters of 2023.

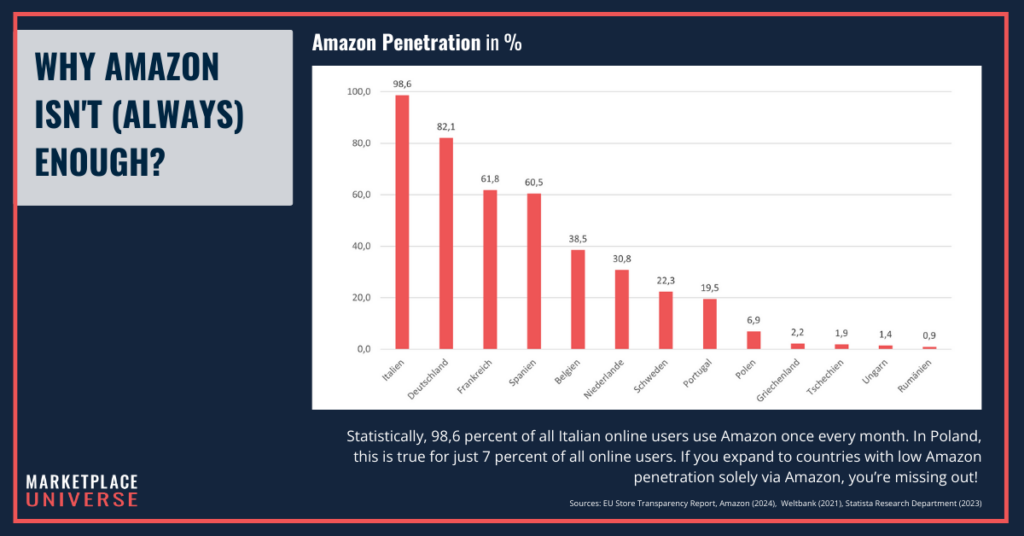

Calculation of „Amazon penetration“

And if you now put these monthly user figures in relation to the total number of online users in this country, you get a value that you can call “Amazon penetration”: This is the proportion of a country’s online-active population that statistically visits an Amazon website once a month.

We had some fun calculating this online penetration for the 12 largest countries in the EU in terms of population – and some exciting findings came to light, for example:

- Statistically speaking, almost every Italian online user surfed Amazon once a month in the second half of 2023. This makes Italy the market with the highest Amazon penetration in Europe (98.6%). Interesting to note: In the first half of the year, Germany was still ahead with a figure of almost 80%. Apparently, the Italian Christmas and Prime Day business is even more Amazon-centric than the German market.

- Despite the strong local hero Bol.com, Amazon regularly reaches a good third of online users in Benelux.

- Portugal and Greece are almost the same size in terms of population. However, while at least 20 percent of online users in Portugal regularly visit Amazon, this figure is only 2 percent in Greece.

- Amazon continues to struggle in the CEE market. Amazon penetration in Poland, the Czech Republic, Romania and Hungary is in the low single-digit range.

Conclusion of Internationalization with Amazon

We find the figures from the EU Store Transparency Report extremely exciting and will continue to keep an eye on them. The more often the report is published, the more insights we will be able to derive about the impact that new Amazon marketplaces (such as Ireland in 2025) will have on Amazon penetration in individual countries. The very different penetration in individual European countries makes it clear why internationalization with Amazon is not always the best solution.