In a Nutshell

JD.com is one of the world’s largest ecommerce companies by GMV — yet outside China, it remains widely misunderstood. Unlike Temu or AliExpress, JD is fundamentally a retailer with a marketplace component, not a pure marketplace platform. Its European ambitions, logistics-first DNA, and retail-led model make it a very different beast — and a very different opportunity — for brands watching China’s ecommerce giants expanding westwards.

⏱ Time to Read: appr. 12 min

From electronics stall to ecommerce giant

JD.com’s origins are far more operational than mythical. Liu Qiangdong, who commonly goes by Richard Liu, founded JD.com in 1998 as a small electronics retail business in Beijing. The company entered ecommerce in the early 2000s, pivoting aggressively after the SARS outbreak accelerated online shopping in China.

The name “JD” stands for Jingdong (京东) — roughly translating to “Capital East” referencing back to the city of its origin. While the abbreviation has since become a global brand, its roots remain deeply practical: selling electronics reliably, at scale and with minimal intermediaries.

From the outset, JD differentiated itself not through openness, but through control — over inventory, pricing, logistics, and customer experience. That decision still defines the company today.

JD’s company structure and ecosystem

JD.com Group operates as a multi-layered commerce and logistics organization, with JD Retail at its core-

- JD Retail

The core business unit overseeing first-party retail. JD Retail buys inventory directly and sells it to end customers, complemented by a selectively managed third-party marketplace. - JD Logistics

A separately listed logistics arm that operates warehouses, fulfilment centres, and last-mile delivery. Unlike Alibaba, JD owns and operates much of its logistics infrastructure directly. - JD Marketplace (3P)

With its marketplace unit, JD does allow selected third-party sellers to use the platform — however, this model is primarily used domestically.

Can I sell my products on the JD Marketplace outside China?

Yes — but in a very limited and controlled way.

JD’s open third-party marketplace operates mostly in mainland China. Outside China, JD does not run a broad, open seller marketplace comparable to Amazon Marketplace or AliExpress. Instead:

- In Asia, JD supports cross-border and regional retail initiatives.

- In Western markets, JD focuses on:

- first-party retail,

- curated partnerships,

- and experimental platforms like Joybuy.

This means that for most Western brands, “selling on JD” does not equal self-serve marketplace access.

JD’s European ambitions and the Ceconomy acquisition

JD’s interest in Europe became tangible through its move to acquire a stake in Ceconomy, the parent company of MediaMarkt and Saturn — Europe’s largest consumer electronics retail group.

Strategically, the acquisition would give JD:

- immediate access to Europe’s electronics-heavy customer base,

- physical retail infrastructure,

- and deep category alignment with JD’s historical strengths.

However, the deal remains under regulatory review. European competition authorities are assessing its potential impact on market concentration in consumer electronics, supplier access and pricing dynamics, as well as data usage and logistics integration.

Until these concerns are resolved, the acquisition remains strategically significant but operationally constrained.

What JD.com actually sells (and in what proportions)

JD’s assortment to this day strongly reflects its origins, as is underlined by ECDB data:

- Electronics & appliances: ~45–50% of total GMV

Smartphones, computers, TVs, and large appliances dominate JD’s revenue base. - Home, FMCG & groceries: ~20–25%

A fast-growing segment supported by JD’s logistics capabilities. - Fashion & lifestyle: ~10–15%

Important, but not central to JD’s positioning. - Health, beauty & personal care: high-growth, single-digit share

Often sold directly by JD or through authorized partners.

What about Joybuy?

Joybuy is JD.com’s international-facing retail and marketplace brand, designed to test JD’s model outside its core Chinese market. Within JD Group, Joybuy represents roughly 2–4% of total GMV, keeping it firmly in single-digit territory and well below the group’s domestic retail operations in scale.

In Europe, Joybuy’s history has been uneven. Earlier expansion efforts across multiple countries were later scaled back after limited traction, leading JD to shut down or pause Joybuy operations in most markets. Only within the United Kingdom, Joybuy was able to really establish itself with a localized online store with JD-managed assortment and fulfilment. In Germany, JD briefly experimented with the brand Ochama and omnichannel concepts before consolidating its international retail presence under the Joybuy name again.

Who shops on JD.com

JD’s customer base skews toward urban, higher-income, and trust-oriented shoppers. These consumers often make higher-consideration purchases — electronics, appliances, and branded goods — where reliability matters more than rock-bottom pricing.

Marketplace Universe Insight:

JD.com is not chasing maximum shopper reach. It is deliberately optimizing for trust, reliability, and high-consideration purchases, reinforcing a consumer perception closer to a premium retailer than a bargain marketplace.

Where JD’s money really comes from

ECDB data places JD.com among the top global ecommerce players by GMV:

| Company | Approx. Annual GMV |

|---|---|

| Alibaba (Taobao + Tmall) | $1T+ |

| Amazon | $700–800B |

| JD.com | $500B+ |

| eBay | $70–80B |

Crucially, less than 10% of JD’s GMV is generated outside China. JD is global in ambition, but still overwhelmingly domestic in revenue.

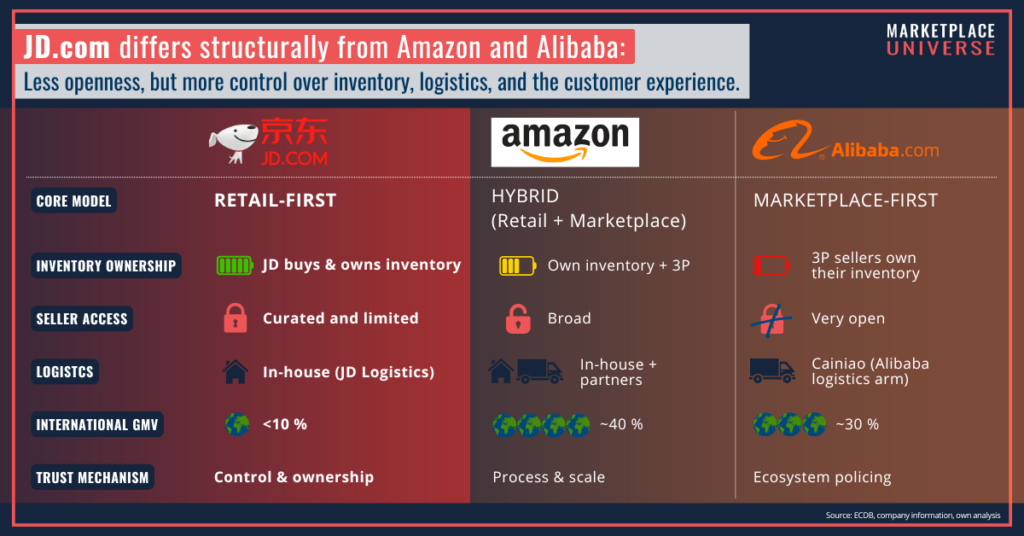

JD vs the big marketplaces: a structural comparison

Key difference:

JD optimizes for control, Amazon for global customer obsession, Alibaba for ecosystem scale

What it really means to sell through JD.com

Joining JD does not usually mean listing products directly.

For most brands — especially outside China — JD operates as a retail partner:

- JD buys inventory from brands or authorized distributors.

- JD controls pricing, fulfilment, and customer service.

- Brands gain access to JD’s customer base without operating day-to-day marketplace logistics.

This model reduces brand control but increases trust, consistency, and operational simplicity.

JD.com Readiness Checklist for Brands

Commercial Fit

- Are you willing to sell inventory wholesale rather than operate a direct-to-consumer marketplace model?

- Can your margins absorb JD-controlled pricing, promotions, and markdowns?

- Is your product strong in electronics, appliances, or high-trust categories, where JD’s customer base is concentrated?

Operational & Supply Chain Readiness

- Can you support bulk purchasing agreements, forecast commitments, and replenishment cycles?

- Are your production and inventory planning systems robust enough to handle retailer-led demand planning?

- Can you meet strict fulfilment, packaging, and quality standards set by JD?

Brand & Channel Strategy

- Are you comfortable with limited control over customer experience, content, and post-sale communication?

- Does JD complement or conflict with your existing retail partners in China or Europe?

- Have you assessed the risk of channel conflict with distributors, marketplaces, or DTC operations?

Compliance & Governance

- Are your products fully compliant with Chinese and EU product safety, labelling, and documentation standards?

- Do you have internal processes to handle JD-led invoicing, tax handling, and audit requirements?

- Can you support enhanced scrutiny related to regulatory oversight and consumer protection?

Strategic Intent

- Is your goal long-term brand building, controlled market entry, or supply-chain partnership — rather than fast marketplace scale?

- Do you have executive alignment that JD is a strategic retail partner, not a short-term sales channel?

Marketplace Universe Insight:

JD.com is not chasing maximum shopper reach. It is deliberately optimizing for trust, reliability, and high-consideration purchases, reinforcing a consumer perception closer to a premium retailer than a bargain marketplace.

Logistics as a competitive weapon

Logistics is JD’s defining capability. Rather than outsourcing fulfilment, JD built a nationwide infrastructure of warehouses, sorting centers, and last-mile delivery operations. This enables same-day or next-day delivery across large parts of China.

Internationally, JD relies more on regional fulfilment hubs and partners, but its logistics mindset remains consistent: speed, predictability, and ownership over critical steps.

Trust, compliance, and brand protection

JD’s retail-led structure changes the trust equation fundamentally. By purchasing inventory directly, JD minimizes risks related to counterfeits, inconsistent quality, and unauthorized sellers. Compliance, invoicing, and customer service are centralized, reducing friction for consumers — and raising the bar for brand participation.

This approach creates fewer seller opportunities, but stronger consumer confidence.

Key learnings

- JD.com is a retailer first, marketplace second

- Electronics and appliances remain its economic backbone

- International GMV is still below 10%

- Joybuy is strategic, not intended for core revenue

- Seller access is curated, not open

- Logistics ownership underpins JD’s trust advantage

- Europe matters — but regulation slows expansion

08.01.2026 – Written by Ricarda Eichler, Journalist and Author for OHN