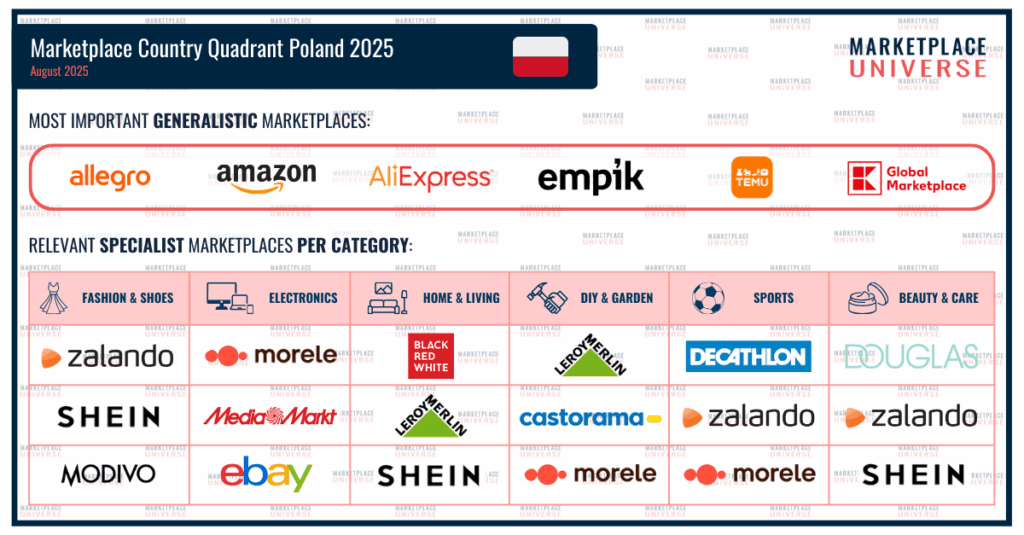

These are the 24 most important B2C marketplaces for selling to POLAND – 2025 Update

Poland remains one of the most vibrant and competitive e-commerce markets in Europe. With strong local players, rising household incomes, and growing interest from international platforms, the country continues to be a dynamic landscape for marketplace sellers. Our updated Marketplace Country Quadrant Poland highlights the most important platforms brands and retailers should know in 2025.

The Market: Growing steadily, but with local guardrails

With a population of 36 million and an average household income of $23,000 (up 6% YoY), Poland has become a serious contender in European e-commerce. In 2024, total e-commerce turnover reached €17.7 billion, up 7.5% from the previous year. The online share of total retail stands at 14.6%, with room for further growth.

More than 60% of Polish consumers shop online regularly. Affordability remains a key driver, but interest in premium and specialized offerings is growing. The top five online stores in Poland in 2024 were:

- Allegro

- MediaExpert.pl

- AliExpress

- Amazon

- Temu

Four of the top five are marketplaces – underscoring the central role they play in Poland’s digital economy.

Marketplace Momentum: Local champions defend their turf

Marketplaces account for 50-60% of Poland’s total e-commerce volume. But what sets Poland apart is the strong position of local champions – most notably Allegro, which continues to dominate with a turnover 10x higher than Amazon.pl.

While Amazon, Temu, and AliExpress are gaining ground, they face significant resistance from established local ecosystems. Other local giants like Empik and Morele are also maintaining their foothold, especially in niche or specialized categories.

That said, the competitive landscape is heating up – and new category dynamics are emerging.

What’s changed since last year?

There have been only minor changes to our Poland quadrant in 2025, but they’re telling:

📉 Exits

- Castorama dropped out of Home & Living – overtaken by Shein in relevance.

- Modivo lost its spot in Beauty due to Shein’s growing footprint in that category.

📈 New Entries

- Modivo has been added back – this time in the Fashion box, where it continues to perform strongly.

🎯 Observations

- Morele is now relevant in three categories: Electronics, DIY & Garden, and Sports (especially for electronics-based fitness gear).

- Vinted was removed from the quadrant but remains highly relevant as a second-hand and off-price channel in Fashion and other soft categories.

- Farfetch is an interesting niche player in high-end Fashion.

- Shein continues to expand, gaining ground in Fashion, Beauty, and Home & Living, but growing more slowly than in Western Europe.

The most important marketplaces in Poland – 2025

🛍️ Generalists

Allegro, Amazon, AliExpress, Temu, Empik

👗 Fashion & Shoes

Zalando, Shein, Modivo

💻 Electronics

Morele, MediaMarkt, eBay

🛋️ Home & Living

Black Red White, Leroy Merlin, Shein

🛠️ DIY & Garden

Leroy Merlin, Castorama, eBay

🏃 Sports

Decathlon, Zalando, Morele

💄 Beauty & Care

Douglas, Zalando, Shein

Poland’s Unique Market Dynamics

Poland’s e-commerce market is maturing, but its trajectory is different from many Western peers. Local players still dominate – not just Allegro, but also large retailers without marketplaces, such as Doz.pl (Beauty), Media Expert (Electronics), or Oponeo (Auto Parts), which remain highly competitive and limit the growth of foreign newcomers.

The lack of local marketplace conversions from these retail giants means global players are stepping in – but slowly and with mixed results. Amazon is still not seen as a leader in Fashion, and Shein’s expansion is notably slower here than in Spain or France.

That said, the demand for variety and cross-border access is growing, which could shift dynamics over time.

Explore More

📍 Compare this quadrant with others: Check out our Marketplace Country Quadrants for Italy, France, Spain, or the Netherlands to see how market dynamics differ across Europe.

🧭 Visit our Quadrants Main Page to explore category-based and country-based analyses.

Do you have anything to add to our country quadrant for Poland? Let us know!