E-commerce in the Nordic countries is booming: Sweden, Norway, Denmark, and Finland are among the most digital markets in Europe, with high internet penetration, strong purchasing power, and a generally open attitude toward international brands. This creates numerous opportunities for online sellers – but also some unique challenges, especially when it comes to shipping to Norway. In this article, we outline how to enter the market, which marketplaces and niches matter, and how exporto can support your growth in the Nordics.

1. Market Overview: Digital, affluent – and demanding

Nordic countries show near-universal internet access: over 94% in all markets, with Norway and Denmark leading at 98%. According to PostNord, around 83% of Nordic consumers shop online at least once a month – in Sweden, it’s as high as 88%. Top-selling categories include fashion, footwear, cosmetics, and electronics. Return rates average around 30%.

Germany is the second most popular cross-border shopping destination (after China), with German products enjoying a strong reputation – a clear advantage for DACH-region sellers.

Economic conditions are also promising: Norway ranks 4th globally in GDP per capita (€87,000), Denmark ranks 10th (€68,000), and both Sweden and Finland exceed €50,000 – well above the EU average. All four countries are seeing strong ecommerce growth: Sweden’s market is expected to rise from €13.64 billion (2025) to €18.61 billion (2029), Norway from €8.84 billion to €12 billion in the same period. Finland and Denmark show similar trends.

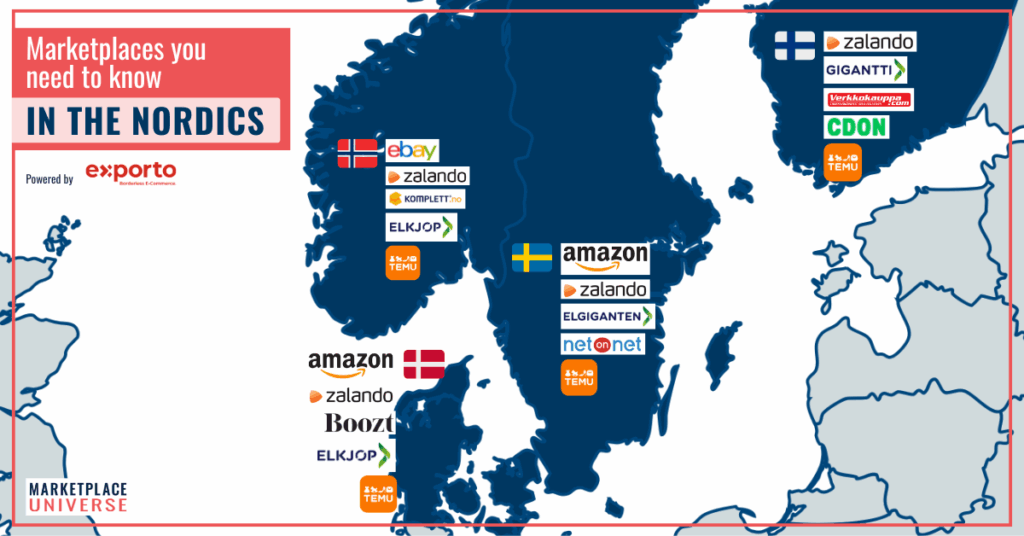

2. Key Marketplaces in the Region

The most popular platforms in the Nordics include well-known global names: Amazon, Zalando, Temu, and eBay. Amazon is especially strong in Sweden and Denmark, while Zalando performs well across all four markets. Temu is growing rapidly thanks to its aggressive pricing. eBay remains a relevant player in Norway, particularly in electronics and second-hand.

Sweden: Local heroes & demanding shoppers

Besides international platforms, several local marketplaces play a vital role in Sweden:

- Elgiganten.se – Leading electronics platform with wide reach and physical presence

- NetOnNet.se – Popular consumer electronics seller with strong online focus

- Blocket.se – Sweden’s largest classifieds platform, strong in second-hand and local offers

Swedish consumers are highly digital and expect a seamless experience. Marketplace loyalty is strong, especially in fashion and electronics. Fast delivery and easy returns are key to visibility and ranking – especially with return rates near 29%. EU membership means no customs processing – a major logistical advantage.

Denmark: International mindset, locally rooted

Denmark is considered the most international of the four markets. Two local marketplaces stand out:

- Boozt.com – Fashion & lifestyle platform with fast shipping and strong private labels

- DBA.dk – Denmark’s top classifieds site, used by private and commercial sellers alike

Danish shoppers have high expectations: deliveries under five days are standard, and MobilePay is a must. Returns often exceed 30%, with parcel shops being the preferred return option. Speed, convenience, and local payment methods are key to success. Promising niches include baby & kids, fitness, and local lifestyle brands.

Finland: Digitally connected & quality-driven

Finland has a diverse marketplace ecosystem with three key platforms:

- Tori.fi – The leading second-hand marketplace, also open to B2B sellers

- Verkkokauppa.com – Tech-focused platform with its own logistics system

- CDON.fi – Multi-category platform for books, electronics, and lifestyle. CDON is now no longer only present in its home market of Finland, but also in Sweden, Denmark, and Norway.

Finnish consumers prefer parcel lockers for pickup – a key consideration for logistics. Sustainability and product functionality are key purchase drivers. Return rates are relatively low at 25%, offering scalability. Popular segments include home & living, books, and advanced tech products.

Norway: High purchasing power, complex logistics

In Norway, local platforms dominate many product segments:

- FINN.no – Norway’s largest classifieds platform with huge reach

- komplett.no – Tech-focused marketplace with a wide assortment and reliable delivery

- Elkjøp.no – Major electronics player with online and offline presence

As a non-EU country, Norway has its own customs and tax regulations. Returns can also incur customs fees. 48% of Norwegian consumers shop internationally – but only when shipping is fast, transparent, and well-managed. Sellers who master these processes, including strict SLAs, can thrive in high-value niches like fashion (via VOEC), outdoor gear, and premium electronics.

Shipping to Norway: What to watch out for

Norway requires specific import procedures:

- VOEC (VAT on E-Commerce): For B2C orders up to 3,000 NOK – simplifies VAT and customs handling

- Regular customs process: Required for higher-value goods, with full registration and tax reporting

Important: returns must also go through proper customs procedures. Mishandling leads to high costs and unhappy customers. Strict SLAs are enforced on major marketplaces like Zalando.

3. How exporto simplifies market entry in the Nordics

exporto provides a full-service cross-border logistics solution for the entire Nordic region – fast, transparent, and with just one integration. exporto handles last-mile delivery and returns via local partners like PostNord, ensuring platform-compliant logistics and real-time tracking.

Especially for Norway, exporto offers a unique advantage: It is the only provider to fully integrate both VOEC and traditional customs processes – automated, compliant, and optimized for marketplace requirements.

4. Conclusion: The Nordics are worth it – with the right partner

The Nordic markets are demanding but full of potential. With digital-savvy consumers, high purchasing power, and strong marketplace ecosystems, sellers who understand local specifics – and choose a strong logistics partner – can scale successfully across Sweden, Denmark, Finland, and Norway.