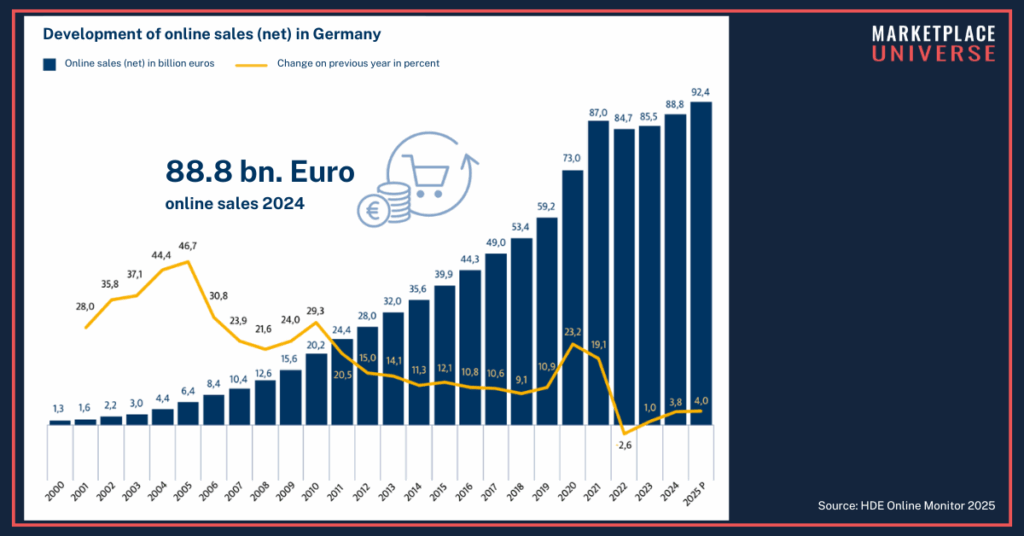

Let’s start with the good news: After a decline in 2022 and only minimal growth in 2023, German e-commerce finally grew again in 2024. Total online sales amounted to €88.8 billion US-Dollar. This represents an increase of €3.3 billion or 3.8% compared to 2023. For 2025, the report forecasts another 4% increase, reaching €92.4 billion. The most notable finding: All of this growth comes from marketplaces. These figures come from the HDE Online Monitor 2025, one of the most important reports on Europe’s second-largest online market after the UK. With its Online Monitor, the German Trade Association (Handelsverband Deutschland HDE) presents the German e-commerce figures for 2024. We have summarized and translated the most important data on the German Online Market 2025 and on the marketplace business.

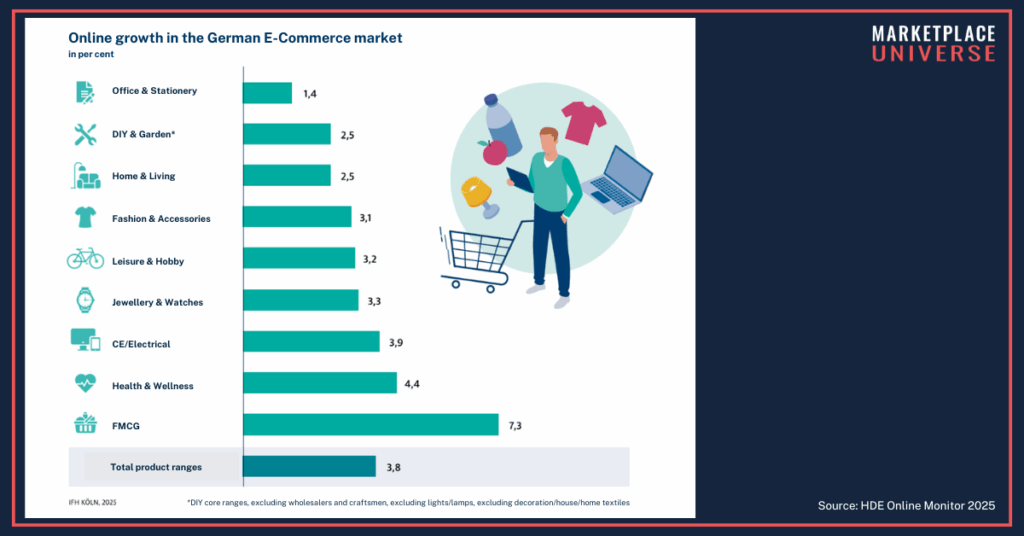

Growth across all categories

For the first time, growth was seen across all product categories, although at different levels. At the lower end, Office Supplies grew by 1.4%, while DIY & Garden and Home & Living each increased by 2.5%. On the higher end, Electronics (CE) and Health & Wellness saw growth of 3.9% and 4.4% respectively. The top performer was FMCG (Fast Moving Consumer Goods), with a 7.3% increase. The average growth across all sectors was 3.8%.

Fashion and Electronics account for the largest share of online sales. In 2024, the Fashion & Accessories category generated €20.6 billion, or 23.2% of total online sales. Electronics followed with €19.1 billion (21.5%), and Hobby & Leisure ranked third with €13.7 billion (13.8%). These shares remained largely stable compared to the previous year. FMCG was again the most dynamic category, increasing its share from 13.3% to 13.7%, with total online sales of €12.2 billion.

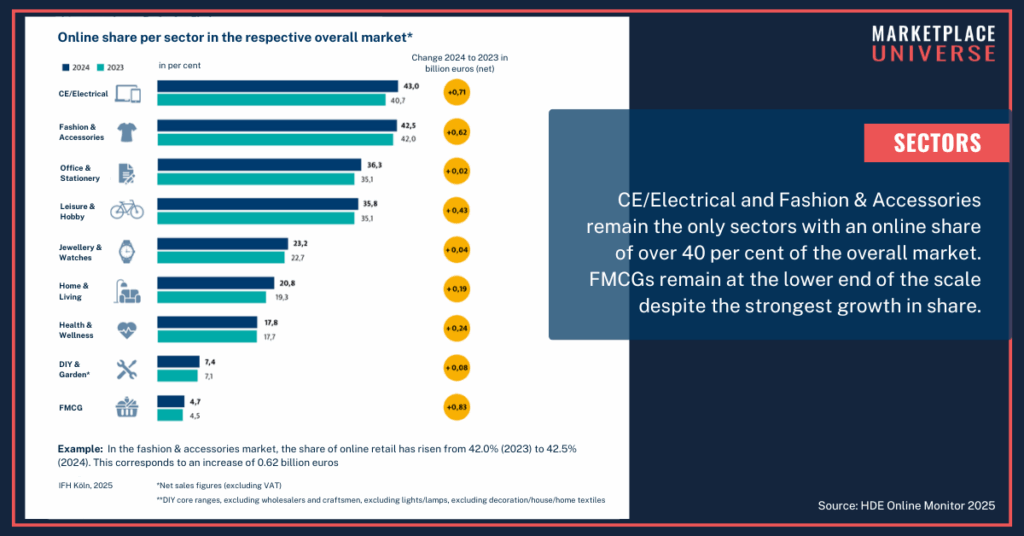

Strong market position for key categories

Despite above-average growth of €830 million, FMCG still holds a small share of the overall market, with only 4.7% online penetration. Electronics leads with 43%, despite industry-wide challenges. Almost one in two electronics items is now purchased online. Fashion also held up well, growing by €620 million and reaching an online share of 42.5%.

Other categories with high online shares include Office Supplies and Hobby & Leisure (over one-third), Watches & Jewelry (nearly one-quarter), and Home & Living (around one-fifth). These figures reflect the post-COVID demand correction in many sectors.

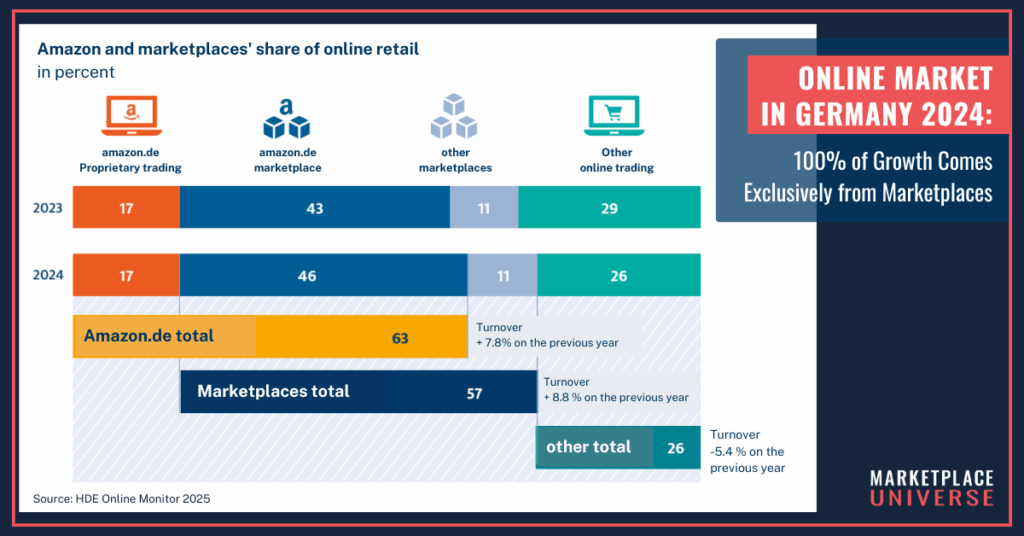

Marketplace-driven growth only

This is the biggest headline: The entire growth in German e-commerce in 2024 came from online marketplaces, led by Amazon. Other online channels saw an average revenue decline of 5.4%. In contrast, marketplaces grew by 8.8%. That means the entire 3.8% overall increase is marketplace-driven.

Amazon.de remains the clear leader, with a 63% share of the German online market – an unmatched figure across Europe. Of that, 17% comes from Amazon’s 1P retail and 46% from third-party marketplace sellers. All other marketplaces combined – including eBay, Otto, Zalando, About You, Moebel.de, and ManoMano – account for just 11% of total online sales. This shows how difficult it is to generate meaningful volume in Germany outside of Amazon – whether via your own webshop, alternative marketplaces, or platform models. It requires a clean execution strategy and realistic cost structures.

Older shopper segments growing

Overall, the number of online shoppers in Germany is growing only slightly, most recently by just under 1%. However, the 55+ age group shows the largest increase, up 1.4% from 2023. On average, German shoppers hit the “buy” button 35 times per year, with an average basket value of around €52.

Cross-border e-commerce is on the rise, especially from China

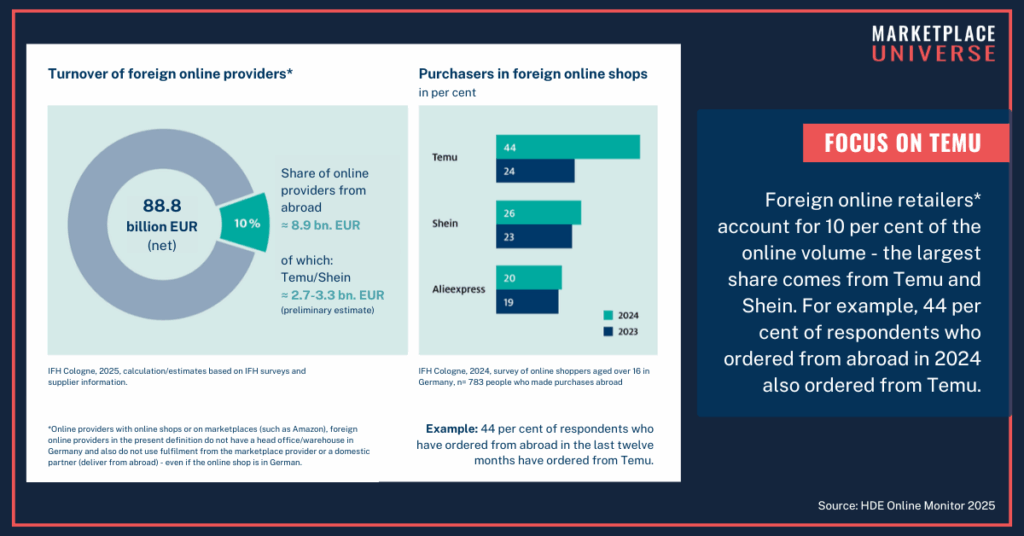

Around a quarter of online shoppers in Germany deliberately shop abroad, most commonly in China. Nearly half of all cross-border orders are made there, followed by Austria, the Netherlands, and the US. Another 15% of shoppers haven’t purchased cross-border yet but are open to it, while 20% want to avoid it entirely.

Roughly 10% of Germany’s e-commerce revenue flows abroad: €8.9 billion out of the €88.8 billion total. The main beneficiaries are Temu and Shein. According to HDE estimates, the two platforms together generated between €2.7 and €3.3 billion in Germany. This is based on 14.4 million customers placing roughly eight orders per year with an average value of €25.

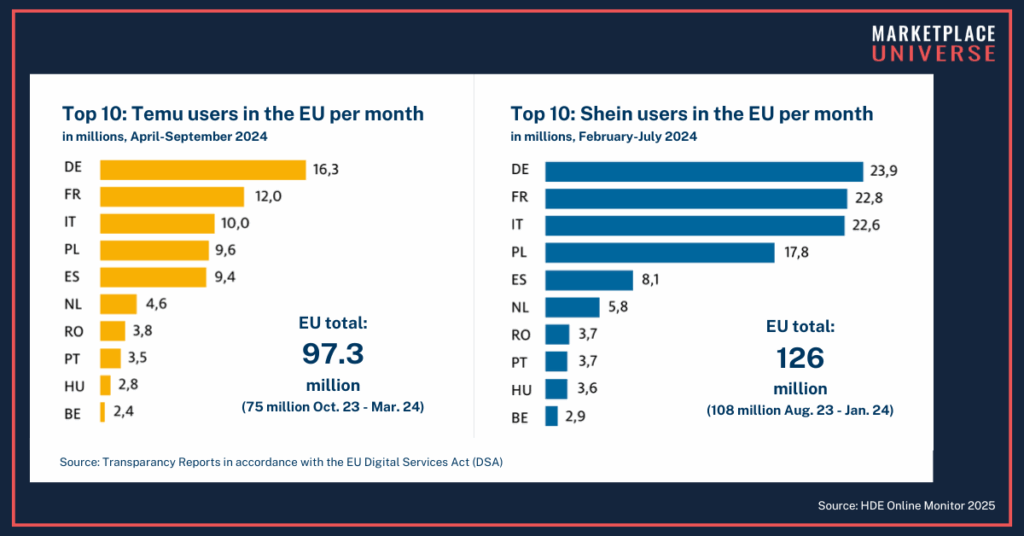

Temu and Shein see massive user growth

Temu had 16.3 million German shoppers between April and September 2024; Shein reached almost 24 million between February and July 2024. Compared to other European countries, Shein sees much stronger traction in France, Italy, and Poland. Temu’s growth is more evenly distributed across markets.

However, Temu struggles with brand perception in Germany: Most shoppers believe the products are of poor quality, and nearly half consider the platform unsafe. As a result, only one in three customers shops there again, and just 25% recommend it to others.

Amazon 1P revenues 5 times higher

Whether Temu and Shein will continue to gain traction in Germany remains to be seen. With its own retail business, Amazon currently generates around €15 billion in Germany – about five times as much as Temu and Shein. But Amazon’s third-party sellers are also increasingly feeling the pressure. Much depends on whether Temu can improve its reputation.

In response, the EU is working to close regulatory loopholes. First steps include a proposed €2-per-parcel fee on shipments from China. In the medium term, the 150-euro duty-free import threshold may also be abolished – though this step isn’t expected before 2028.

Second-hand market booming

A major product segment excluded from the HDE report is second-hand goods. Because much of this trade happens consumer-to-consumer, it’s not reflected in official sales data. However, in 2024, pre-loved products accounted for an estimated €9.9 billion in revenue – in addition to the reported e-commerce total.

Over the past five years, this market has grown by an average of 11% per year. During the COVID years 2020 and 2021, the growth was particularly strong. From 2023 to 2024, the increase was a solid 7%.

The strongest demand is seen in Fashion & Accessories and Books, where second-hand accounts for 17% and 16% of all online purchases, respectively. Other relevant categories include Electronics, Home & Living, and DIY & Garden. Leading platforms in this space include Vinted, eBay, and Kleinanzeigen, while Refurbished, Backmarket, and MediaMarktSaturn dominate electronics.

Conclusion: What the German online market 2025 tells brands and sellers

German e-commerce is growing again – but selectively. All growth comes from marketplaces, while webshops and D2C models are losing traction. Brands relying on their own traffic will need sharp differentiation or a clear niche strategy. Amazon remains the dominant player, but Temu and Shein are gaining ground fast – with aggressive pricing, broad reach, and high order frequency. Their influence will continue to grow despite image problems and pending regulation. FMCG, Electronics, and Second-Hand are key growth areas, even beyond traditional assortments. Brands that successfully leverage trends like pre-loved, sustainability, or inflation-driven demand shifts can reposition themselves strategically. Marketplaces are no longer optional in 2025 – they are the foundation of every scalable online strategy. What matters now is not whether you’re present, but how: through structured assortments, realistic margins, and operational excellence.

See the full report in German here: https://einzelhandel.de/images/Konjunktur/Online_Monitor_2025_HDE.pdf

Stay informed and never miss a marketplace update by signing up for our “Marketplace Universe Weekly” newsletter at http://www.marketplace-universe.com/newsletter. Don’t miss any more Marketplace news!