IN A NUTSHELL

Vinted is growing rapidly in Europe – but by no means everywhere. While some countries such as the UK and Portugal are leading the way with double-digit growth rates, saturated markets like Germany are noticeably slowing the momentum. The range from -25 to +72 percent clearly shows how differently re-commerce works across Europe. Our overview explains where and why Vinted is gaining market share – and where it isn’t.

⏱ Time to Read: appr. 6 min

Vinted in Europe: Market Position, Growth, and Competitive Dynamics

Vinted has established itself in recent years as the dominant European player in the C2C second-hand fashion segment. The platform clearly focuses on second-hand fashion for price-conscious buyers, high liquidity, and scalability driven by network effects. Despite opening up to merchants via Vinted Pro, the business model remains primarily geared toward the mass market and private sellers; Vinted is positioned neither as a generalist nor as a curated luxury marketplace.

Since 2020/2021, Vinted has grown strongly – in terms of user numbers, transactions, and geographic coverage. Since 2022/2023, Vinted has been profitable; however, the company does not disclose concrete financial figures. Estimates place annual GMV in the range of €8 to €10 billion. This makes Vinted one of the largest second-hand platforms in Europe.

The success is based on a clear operational logic: Vinted optimizes for transaction frequency and repeat usage rather than high basket sizes or curated assortments. Low prices, low entry barriers for private sellers, and standardized processes ensure high listing turnover and strong network effects. In its own communication, Vinted positions itself accordingly as a simple, affordable, and sustainable alternative to buying new – an understanding that supports rapid scaling across many markets.

This strategy is underpinned by the expansion of infrastructure. With Vinted Go, the company has been investing since 2022/23 in shipping solutions focused on parcel shops, convenience, and cost control, albeit in a hybrid model with logistics partners. At the same time, the platform is increasingly taking control of payment processing with Vinted Pay, using regulated payment structures (EMI) and relying on escrow and buyer protection mechanisms.

👉 Strategically, this increases the stickiness of the ecosystem: once users are in the wallet/escrow system, they tend to stay on the platform longer – an important lever in markets where price competition (Shein, Temu, Amazon) is very intense.

Fashion Ranking: Vinted in European Comparison

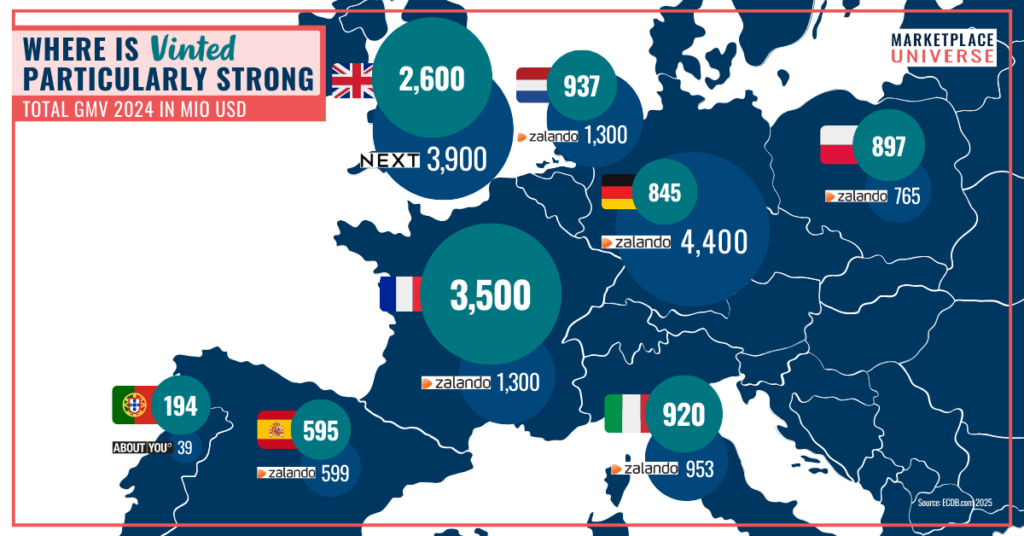

Nevertheless, Vinted’s market position varies significantly across Europe. An analysis of ECDB data shows how the platform ranks among the largest online fashion providers in each country.

• France – Rank 1

• Poland – Rank 2

• Germany – Rank 3

• Portugal – Rank 3

• Netherlands – Rank 4

• UK – Rank 5

• Italy – Rank 6

• Spain – Rank 7

Market Sizes: France Clearly Leads, Germany Only Mid-Table

France remains by far the largest market, even though growth there has slowed slightly. Despite its large population and purchasing power, Germany sits only in the middle of the field. Based on GMV, the following picture emerges for 2024:

- France: $3.5 bn – clear lead market

- UK: $2.6 bn – dynamic growth market

- Netherlands: $0.94 bn

- Italy: $0.92 bn

- Poland: $0.9 bn

- Germany: $0.84 bn

- Spain: $0.6 bn

- Portugal: $0.19 bn

Growth Rates: Major Differences Across Europe

GMV growth rates show a highly divergent picture – ranging from significant declines to exceptionally strong increases. The spread from -25% to +72% illustrates how much levels of development, competition, and recommerce adoption differ across Europe.

Markets with Very Strong Growth

• Portugal: +72%

• UK: +54%

• Netherlands: +54%

• Italy: +34%

These countries are characterized by a less crowded recommerce environment and growing demand for second-hand offerings. Vinted mainly competes there with generalist platforms such as Amazon, bol, or Shein, while specialized recommerce providers are largely absent. This facilitates rapid gains in market share. Portugal stands out with the highest growth rate, demonstrating how dynamically a young recommerce market can develop.

Markets with Decline

• Germany: -25%

• Poland: -15%

• France: -2%

In Germany and Poland, the established competitive landscape plays a key role: in Germany, Amazon and Zalando dominate the market, while in Poland Allegro and Zalando in particular hold strong positions. In addition, the growing presence of highly price-aggressive players such as Shein and Temu adds pressure. Germany’s decline of -25% is particularly pronounced and marks the sharpest drop in the European comparison. Overall, the declines point more toward high market maturity and limited additional growth potential.

Luxury as a Side Topic – the Rebelle Example

The attempt to open up new growth fields via the luxury segment failed. In 2022, Vinted acquired the curated luxury marketplace Rebelle but allowed it to continue operating independently; insolvency and closure followed in 2024. The experiment clearly illustrates the limits of the Vinted logic: a service-intensive luxury model could not be scaled and was not transferred into the core platform. Luxury therefore remains an add-on, not a second strategic pillar.

Conclusion: A European Success – with Clear Limits

• European markets differ significantly: everything from dynamic growth to clear saturation is represented.

• France remains the lead market and a central stabilizing factor – despite slight declines.

• The UK, the Netherlands, and Italy are among the most important growth markets in the coming years.

• Germany stands out with a significant decline; Poland also shows negative dynamics.

• Vinted grows primarily where competition is less dense and recommerce has become more mainstream – a pattern that is likely to remain influential going forward.