In a nutshell

AliExpress Europe is gaining strong momentum, evolving from a low-cost export site into a localized marketplace with EU warehouses and faster delivery. This article highlights the platform’s strongest markets by GMV and user reach, its top-selling categories, and how shopper behavior is changing across the continent. It also examines what this means for European brands and retailers — and whether AliExpress Europe is a chance or a challenge for them.

⏱ Time to Read: appr. 7 min

AliExpress in Europe: From Bargain Basement to Billion-Dollar Player

Once dismissed as a marketplace for cheap gadgets and fakes, AliExpress has quietly become one of Europe’s fastest-growing shopping platforms.

In 2025, the Alibaba-owned giant reached top marketplace rankings in Spain, France, and Portugal, with very high usage in several countries — especially across Southern Europe.

Behind this rise is a simple formula: low prices, faster delivery, and a new generation of value-driven shoppers who no longer care where a parcel ships from — as long as it’s affordable, traceable, and arrives quickly.

So what’s fueling AliExpress Europe’s momentum — and what should brands and retailers make of it?

From Factory Floors to European Doorsteps

Launched in 2010 as an offshoot of Alibaba’s B2B platform, AliExpress began as a cross-border export channel for Chinese manufacturers.

For much of the 2010s, its presence in Western markets was marginal, with activity concentrated in Russia, Brazil, and Eastern Europe.

That changed around 2018, when Alibaba invested heavily in European localization:

- Country sites in Spain, France, and Italy

- EU-based logistics via Cainiao

- Partnerships with influencers and local marketing pushes

Since 2022, those investments have paid off. AliExpress has climbed into top marketplace rankings in multiple European markets, combining factory-direct prices with EU delivery times.

Marketplace Universe Insight:

What started as a global outlet for Chinese factories has evolved into a localized retail channel — fast, flexible, and increasingly European in logistics and presentation.

What Europeans Buy on AliExpress

AliExpress’s strengths haven’t changed: it’s built for volume, variety, and value.

The best-performing categories remain those that travel easily cross-border and appeal to impulse buyers.

Top categories on AliExpress Europe:

- Apparel, fast fashion, and accessories

- Small consumer electronics and phone gear

- Home & kitchen gadgets, décor, and DIY tools

- Beauty accessories and low-cost cosmetics

- Toys, hobby products, and seasonal novelties

Because of the platform’s low-price orientation, listings are dominated by trend-led, commodity-style SKUs rather than premium branded products.

Yet the rise of official brand stores and EU-stock sellers signals a gradual shift toward more trust and consistency.

Who Shops on AliExpress — and Why It Matters

AliExpress attracts a price-sensitive but diverse audience. The platform’s transparency reports under the EU Digital Services Act (DSA) provide rare visibility into its European reach. See the full analysis of the EU Transparency reports for AliExpress, Shein, Temu and TikTok here!

By the numbers (HY1 2025):

- Spain: 72.5 % penetration

- Romania: 59.8 %

- Portugal: 50.1 %

- Lithuania: 129.5 % (multi-device usage likely)

Big markets by audience:

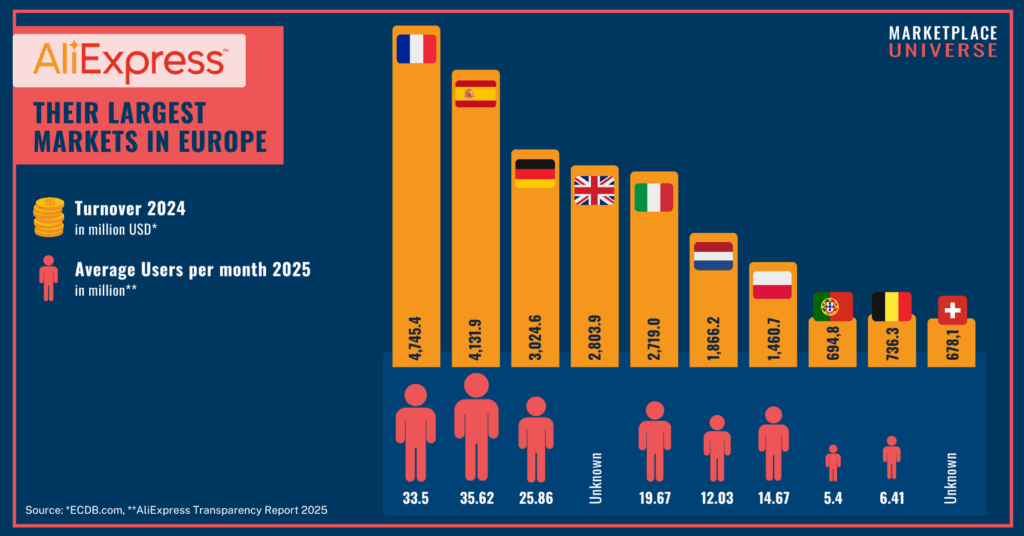

France (33.5 M users), Spain (35.6 M), Germany (25.8 M), Italy (19.7 M), Poland (14.7 M)

Fastest-growing markets:

Lithuania (+147.7 % YoY), Austria (+83.9 %), Czechia (+82.5 %), Sweden (+75.7 %), Romania (+60.1 %)

AliExpress Europe has moved beyond bargain hunters. The platform is winning mainstream users — including mobile-first, middle-income shoppers in Western Europe.

Where the Money Flows

AliExpress is no longer a marginal player. According to ECDB.com, its global GMV reached $639.3 B in 2024, up 33.5 % year-on-year, driven entirely by third-party sellers. That’s nearly 100× growth since 2014.

Top European markets by GMV (2024):

- France – $4.65 B (7.3 %)

- Spain – $3.99 B (6.3 %)

- Germany – $2.97 B (4.6 %)

- United Kingdom – $2.75 B (4.3 %)

- Italy – $2.60 B (4.1 %)

Other notable markets: Netherlands ($1.81 B), Portugal ($0.66 B), Poland ($1.39 B), Czechia ($0.40 B), Hungary ($0.37 B)

Category breakdown:

- Fashion: $19.8 B (31 %)

- Electronics: $13.3 B (21 %)

- DIY & Tools: $13.6 B

- Homeware & Leisure: $16.7 B

- Smaller segments: Groceries ($3.8 B), Personal Care ($2.0 B), Toys ($2.9 B)

Globally, Europe accounts for roughly 25–30 % of AliExpress GMV, making it a critical growth region behind China, the U.S. ($9.63 B), and South Korea ($6.85 B).

Marketplace Universe Insight:

The numbers are real — but so is the competition. To win on AliExpress Europe, brands need price discipline, fast delivery, and localized content.

How to Sell on AliExpress Europe

AliExpress remains one of the most accessible marketplaces for global sellers — but accessibility also means saturation.

To stand out, brands need to master both cost control and content localization.

Seller Landscape

- Individual sellers: Small merchants and entrepreneurs targeting global buyers

- Established brands: Increasingly using AliExpress to test new markets

Fees

- Commission: 5–8 %, depending on category

- Annual platform fee: $130–$1,300, depending on category

- Listing fees: None

Fulfillment

- Cainiao Network: Alibaba’s logistics backbone, offering AliExpress Standard Shipping and Cainiao Super Economy.

- Local+ Program (since 2025): Enables EU-based fulfillment from warehouses in Spain, France, Germany, Poland, and the UK, marked by a Local+ badge for faster delivery and returns.

Marketplace Universe Insight:

For European sellers, Local+ can be the difference between being seen as “cheap” or “trusted.” Faster delivery and local returns drive repeat purchases and better reviews.

Compliance, IP, and Customer Trust

Tax & VAT Compliance

Since July 2021, AliExpress applies the Import One-Stop Shop (IOSS) system for EU orders under €150 — collecting and remitting VAT directly.

For higher-value shipments, VAT and customs are handled at import.

Outside the EU, local tax rules apply (e.g., U.S. state sales taxes). Sellers must ensure compliance across all jurisdictions.

Intellectual Property Protection

AliExpress runs an IP Protection (IPP) platform where brands can register trademarks and report counterfeit listings.

However, enforcement gaps remain: the European Commission has criticized AliExpress for failing to fully prevent unsafe and counterfeit products.

Consumer Trust

Despite improvements in buyer protection and VAT handling, reputation remains AliExpress’s weak spot.

Frequent issues include delayed shipping, inconsistent product quality, and safety concerns.

To rebuild confidence, AliExpress offers:

- Buyer Protection Program: Refunds for undelivered or misrepresented items

- Escrow Payments: Funds released only after buyer confirmation

- Transparent Seller Ratings: Public reviews and order histories

Marketplace Universe Insight:

AliExpress Europe is walking a tightrope — balancing scale with trust. Its biggest challenge now isn’t logistics, but perception.

Should Retailers and Brands Pay Attention?

A tentative Yes — but selectively!

AliExpress Europe offers huge volume potential, yet not every brand will thrive there.

It’s an attractive channel for:

- Fast-fashion brands looking to expand their D2C reach

- Accessory, electronics, or DIY sellers with strong price competitiveness

- Value-driven categories with low returns and high SKU rotation

For premium or niche brands, the platform can serve as a market test lab — but reputation and pricing must be carefully managed.

Conclusion

AliExpress is no longer just “that cheap Chinese site.”

It’s now a serious European marketplace, blending low-cost sourcing with local logistics and billions in GMV.

For brands, the question isn’t if it matters — but how to use it strategically without compromising quality or trust.

AliExpress Readiness Checklist for Retailers and Brands

Market Fit & Competitiveness

- Is your category competitive in a price-driven marketplace?

- Are your listings optimized for multilingual SEO and AliExpress search?

- Do you meet EU labeling and product safety requirements?

Technical & Data Readiness

- Can your systems (ERP, PIM, etc.) sync with AliExpress integrations?

- Do you have multilingual customer support capacity or automation?

Tax & Legal Compliance

- Are you registered for IOSS or aware of your tax obligations outside the EU?

- Can your accounting system handle cross-border invoicing and VAT reconciliation?

Logistics & Returns

- Is your fulfillment setup ready for cross-border orders?

- Have you evaluated Cainiao or Local+ for faster delivery and easier returns?

Brand Protection & Growth Goals

- Do you monitor for counterfeit or IP misuse?

- Have you defined clear success metrics — visibility, testing, or sustainable sales?

28.10.2025 – Written by Ricarda Eichler and Ingrid Lommer