Temu invites EU sellers to marketplace

This has been a long time coming: In March, Temu first invited sellers to their US platform, moving slightly away from their factory-to-consumer model to tentativley open towards a more traditional marketplace model. From then on, US based sellers can list their products on Temu, sending orders from their own warehouses. Now, Temu has brought this new approach to Europe.

This week, Zixia Yi, who according to her LinkedIn profile is responsible for Temu’s seller acquisition in the EU market, posted:

“As of July, the [Temu] marketplace is officially open for registration for businesses with EU entities, including those based in Germany, France, Italy, Spain, the UK, and the Netherlands.”

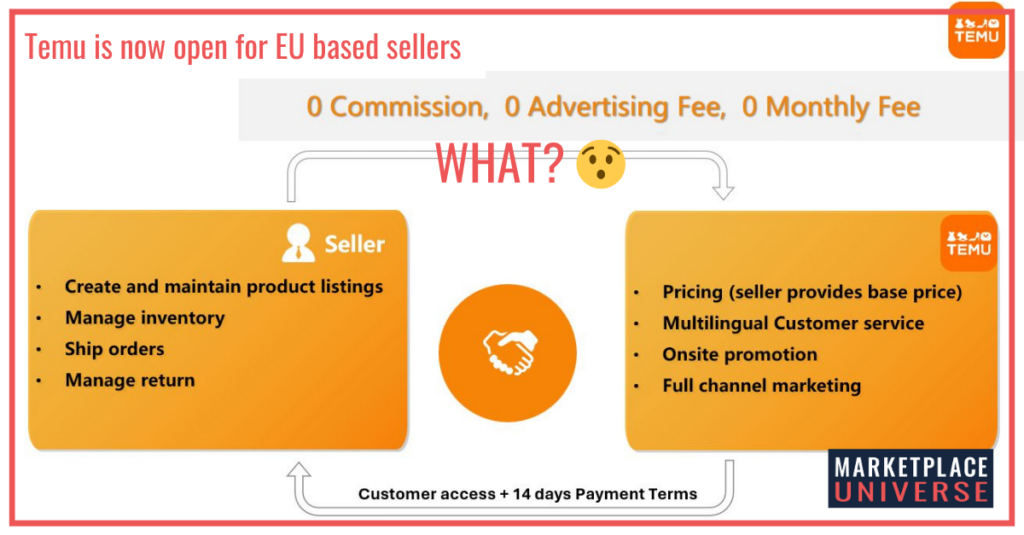

So, from now on sellers based in Europe can list their products on everybody’s least favorite retail nemessis. They are responsible for product listing, warehousing, logistics and returns; Temu, on the other hand, will handle for product pricing (whereby the seller is apparently allowed to set at least a base price), customer service and marketing, both on and off-site.

Conditions for selling on Temu

The costs? 0 – at least according to information provided by Zixia Yi. At the moment, there is “no entry fee, no commission, no advertising fee and no monthly fee” she told Marketplace Universe. Several retailers report from their own talks with Temu, that these conditions are supposedly fixed for the foreseeable future. Temu’s business model: The sellers set a fixed minimum price (which is matched with their lowest price on Amazon), while Temu handles the pricing on the platform. If the item is sold for a higher, Temu keeps the difference to the minimum price.

To sell on Temu, companies have to be registered in Germany, France, Italy, Spain, the Netherlands or UK. And they need a local VAT ID for the EU country they wish to sell to. At the moment, the process for selling is invite-only: Interested seller have to contact Zixia Yi. If they get Temu’s approval, selling can begin within a few days.

Temu’s goals in Europe? Look at the US market

Temu’s new offer is not surprising. In March, the platform opened up to sellers based in the USA. Since then, the proportion of locally shipped orders in the USA has risen sharply: 20 percent of Temu’s US sales are now being generated via local department stores, according to a recent report in the US business magazine The Information. However, these sales have so far been made almost exclusively by Chinese companies with a US branch, according to Marketplace Pulse – and virtually no American retailers.

If you take the US market as a blueprint for Temu’s goals in the EU, opening up to the classic marketplace (and thus a partial departure from the revolutionary factory-to-consumer principle?) seems to be more about speeding up delivery and passing on logistics costs to retail partners than about expanding (or improving the quality of) the product range. On the American Temu app – under the label “Local warehouse” – you will find mostly the same or comparable products as the suppliers from China; only the delivery time is longer and the prices are usually slightly higher.

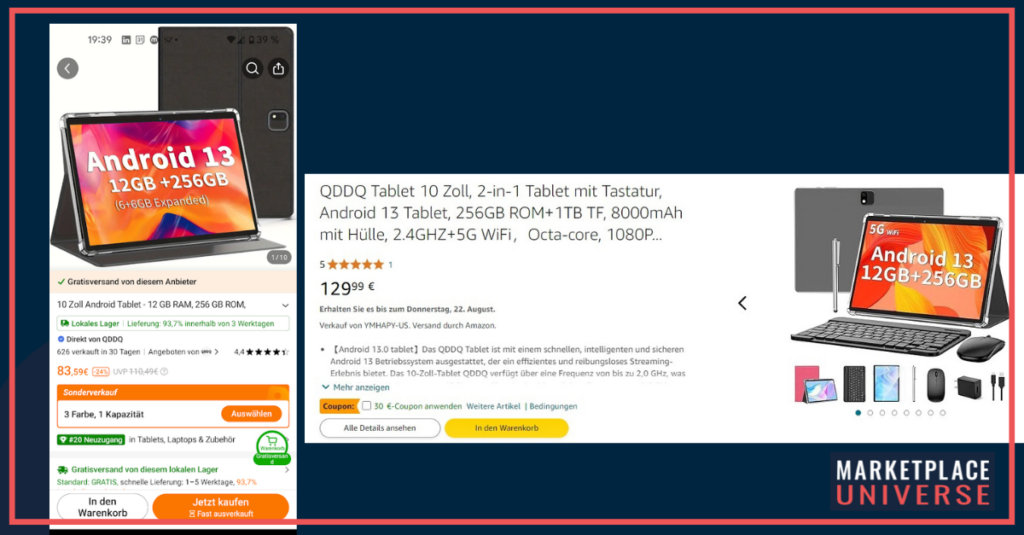

A quick scroll through the German Temu app shows the same pattern: There are several offers with the new “local warehouse” label, e.g. from the Chinese electronics sellers KXD Direct and QDDQ, both of which also sell their products via FBA on Amazon. Incidentally, an identical tablet from QDDQ costs 129.99 on Amazon and 83.59 on Temu, both of which can be delivered within 3 days.

Who will take up Temu’s offer?

It almost sounds as if the classic Chinese import crate-pusher retailers, which were already almost dead on Amazon, are getting a second chance here… But will there be much for them to earn on the low-cost platform if they don’t push the Chinese manufacturers even harder on price than Temu already does?

The offer will still find willing participants, says Austrian retail expert Markus Miklautsch who discovered Yi’s post on LinkedIn first: “The fact that Temu is now looking for a direct route to producers and retailers in the EU, and is communicating this publicly shows us how quickly we have to react. In my opinion, producers from Europe will also use this marketplace to sell to customers in the long or short term. Of course, this will also change the trade. Of course, we know that many customers don’t buy there. But we can no longer rest on our laurels, because our advantages are diminishing.”