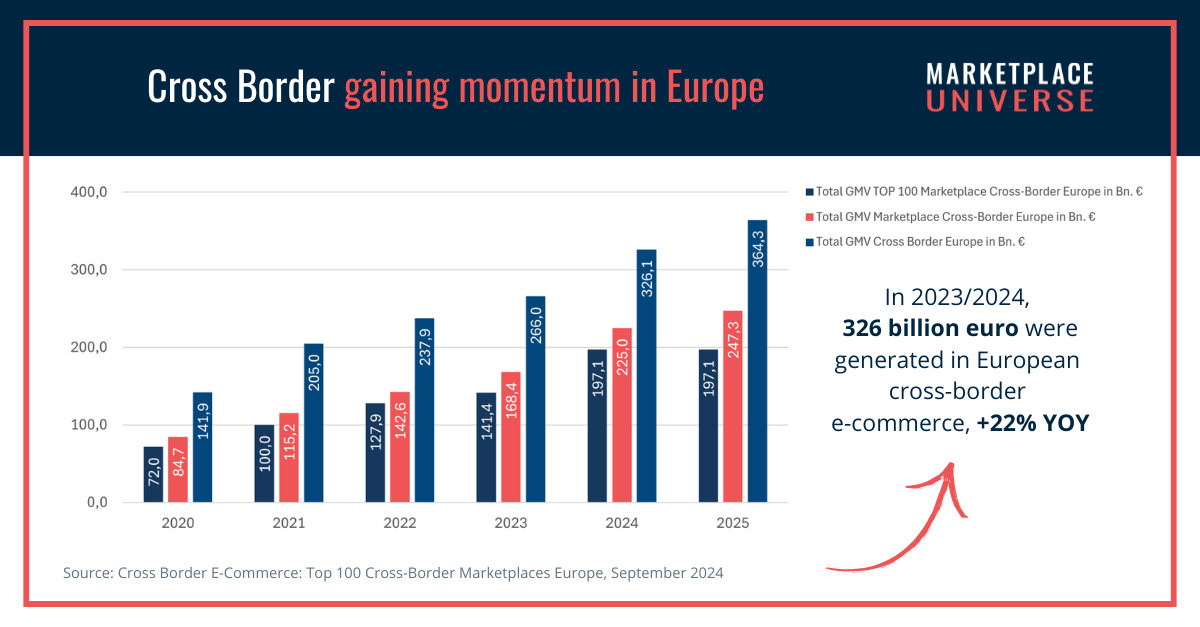

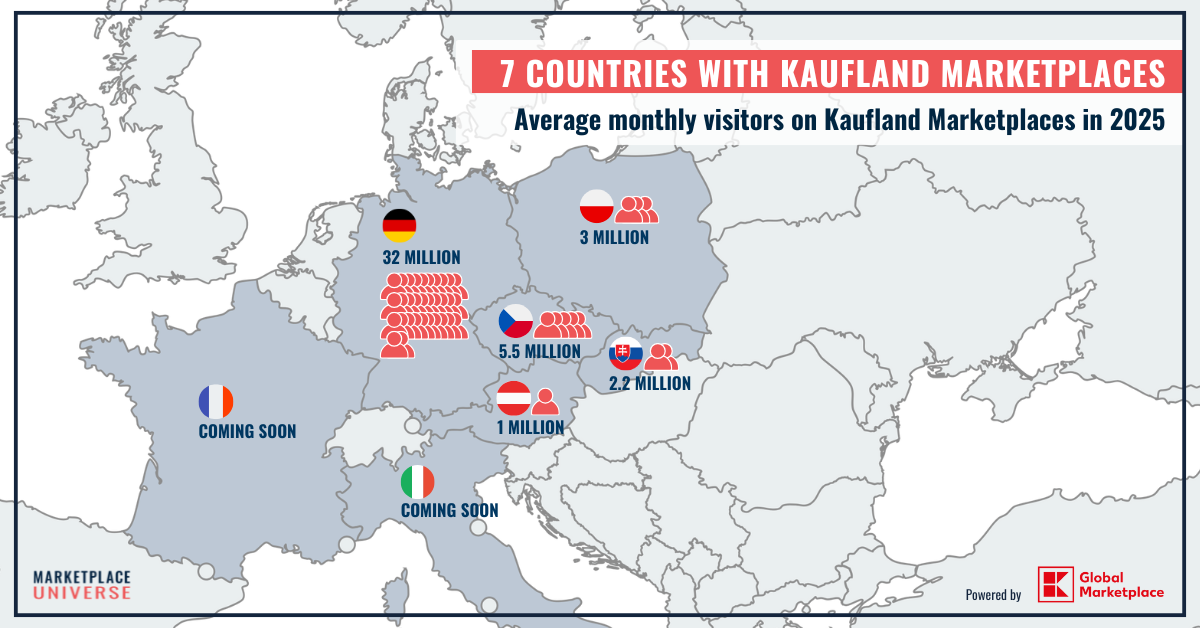

When we talk about international expansion, we often focus on market research, business models, channel strategies, and high-level decisions. So what does expansion really look like for brands and sellers in day-to-day practice? And how can going cross-border be made as simple and efficient as possible? Kaufland Global Marketplace is good example for a marketplace that really tries to help...