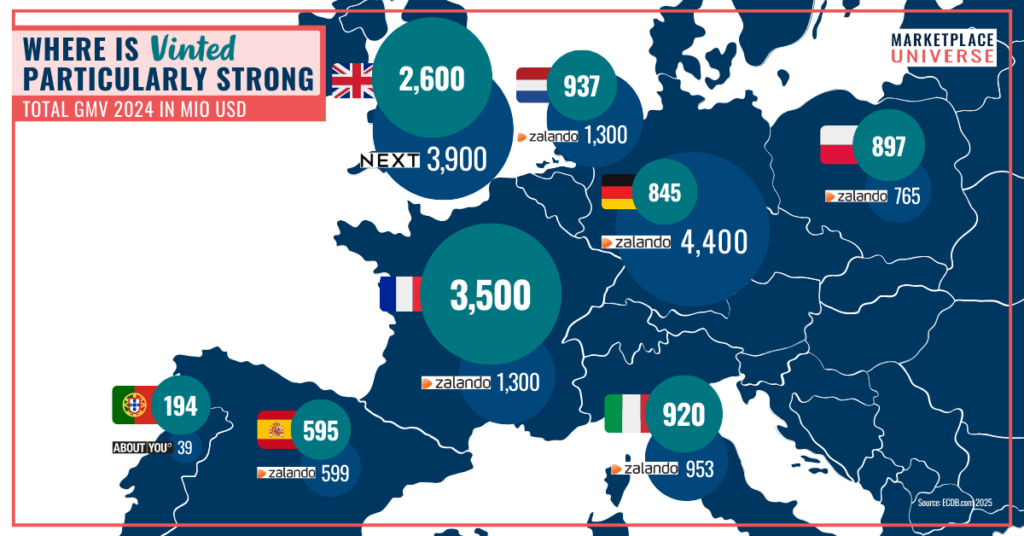

Vinted in Europe: Market Position, Growth, and Competitive Dynamics

Vinted is growing rapidly in Europe – but by no means everywhere. While some countries such as the UK and Portugal are leading the way with double-digit growth rates, saturated markets like Germany are noticeably slowing the momentum. The range from -25 to +72 percent clearly shows how differently re-commerce works across Europe. Our overview explains where and why Vinted is gaining market share – and where it isn’t.